Money Transmitter License: What It Means for Crypto Businesses

When working with money transmitter license, a state‑issued authorization that lets a company move money for customers. Also known as MTL, it sits at the heart of any platform that handles deposits, withdrawals or transfers of crypto or fiat. Without it, most exchanges would be shut down by regulators overnight.

Why the License Matters for Crypto Platforms

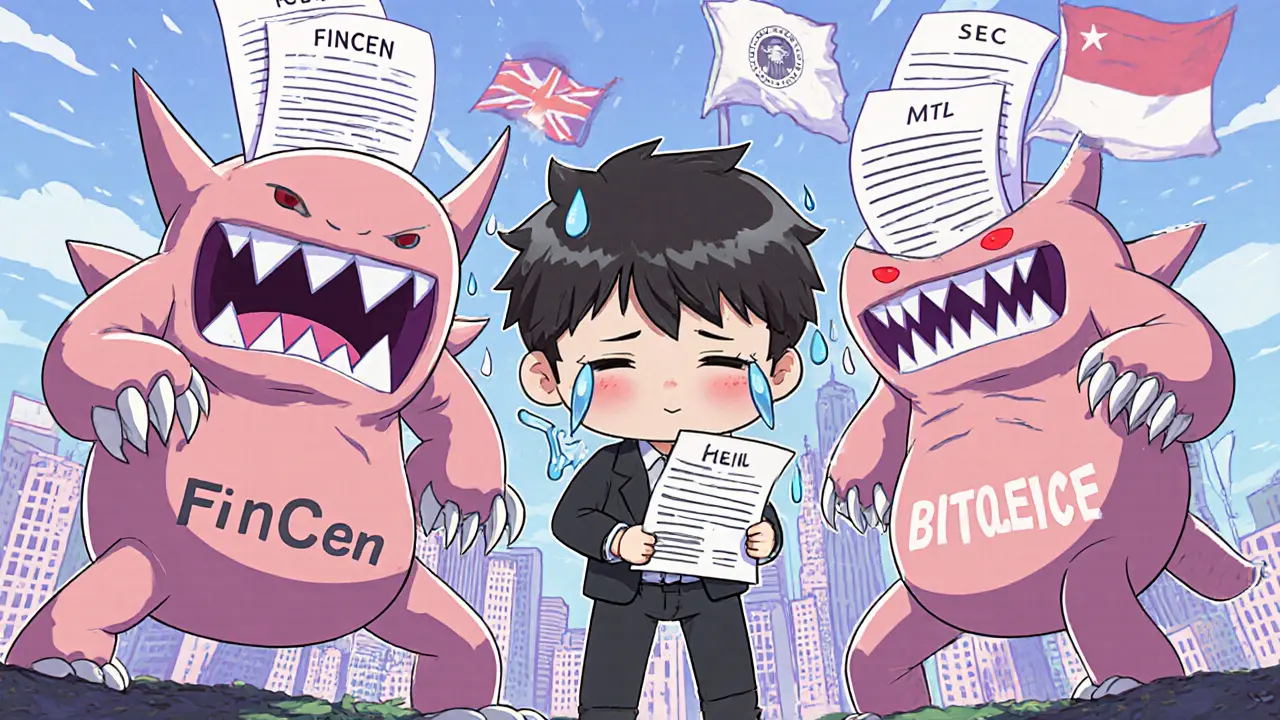

Crypto exchange regulation, the set of rules that govern how digital asset markets operate directly references the money transmitter license. In the U.S., each state’s financial department treats an exchange like a traditional money services business, demanding a license before it can accept user funds. This creates a chain: a license requires AML compliance, processes that detect and report suspicious transactions, and AML programs in turn shape the exchange’s internal policies, KYC screens and reporting tools.

Think of the license as a passport and AML as the visa stamp. If you skip the stamp, you’ll be flagged at the border. That’s why many articles on our site, like the guide on Turkey’s crypto restrictions or the China ban timeline, stress that regulators look first at whether a firm holds a valid money transmitter license before they even examine its technical security.

Beyond the license itself, financial licensing, broader authorizations for banking‑like activities often overlap. A crypto platform that wants to offer interest‑bearing products or stablecoin custodial services may need a separate banking charter or a partnership with a licensed bank. This is where blockchain banking services, applications of distributed ledger tech in traditional banking functions come into play. They give regulated banks a way to interact with crypto without losing their license, and they give exchanges a bridge to compliance.

All of this ties back to the central question: does your project need a money transmitter license? The answer depends on three factors – the jurisdictions you serve, the assets you move, and the services you provide. If you let users buy crypto with a credit card, you’re instantly in the money‑transmission space. If you only let users trade between crypto pairs on a DEX and never touch fiat, some regulators may view you as a software tool rather than a transmitter. The line is blurry, which is why many of our posts, like the review of JAMM Trading or the analysis of FairySwap, compare how different platforms handle licensing across regions.

Regulators also care about who is behind the platform. A reputable compliance officer, a clear corporate structure, and transparent ownership can ease the licensing process. In contrast, anonymity‑focused projects like Monsoon Finance’s MCASH airdrop or the Skrumble Network token often struggle to get approval because they lack identifiable leadership. That’s why the “Money Transmitter License” tag gathers articles ranging from technical guides (Bitcoin block structure) to policy deep‑dives (Myanmar crypto ban) – they all illustrate how technical design and regulatory strategy intersect.

When you’re planning a new exchange or adding fiat on‑ramps, start by mapping the licensing requirements in each target market. Identify the state or country’s money‑transmitter regulator, check if the jurisdiction treats crypto as a commodity or a currency, and build an AML program that meets the local thresholds. Once you have that framework, you can focus on product features, user experience, and growth tactics without fearing a sudden shutdown.

Below you’ll find a curated collection of articles that break down each piece of this puzzle. From country‑specific restrictions in Turkey and Iceland to practical exchange reviews like Bitexblock and ZigZag, the posts give real‑world examples of how a money transmitter license shapes strategy, risk, and opportunity. Dive in to see how the concepts we’ve discussed play out across the crypto landscape.