Crypto Business License: What You Need to Know to Operate Legally

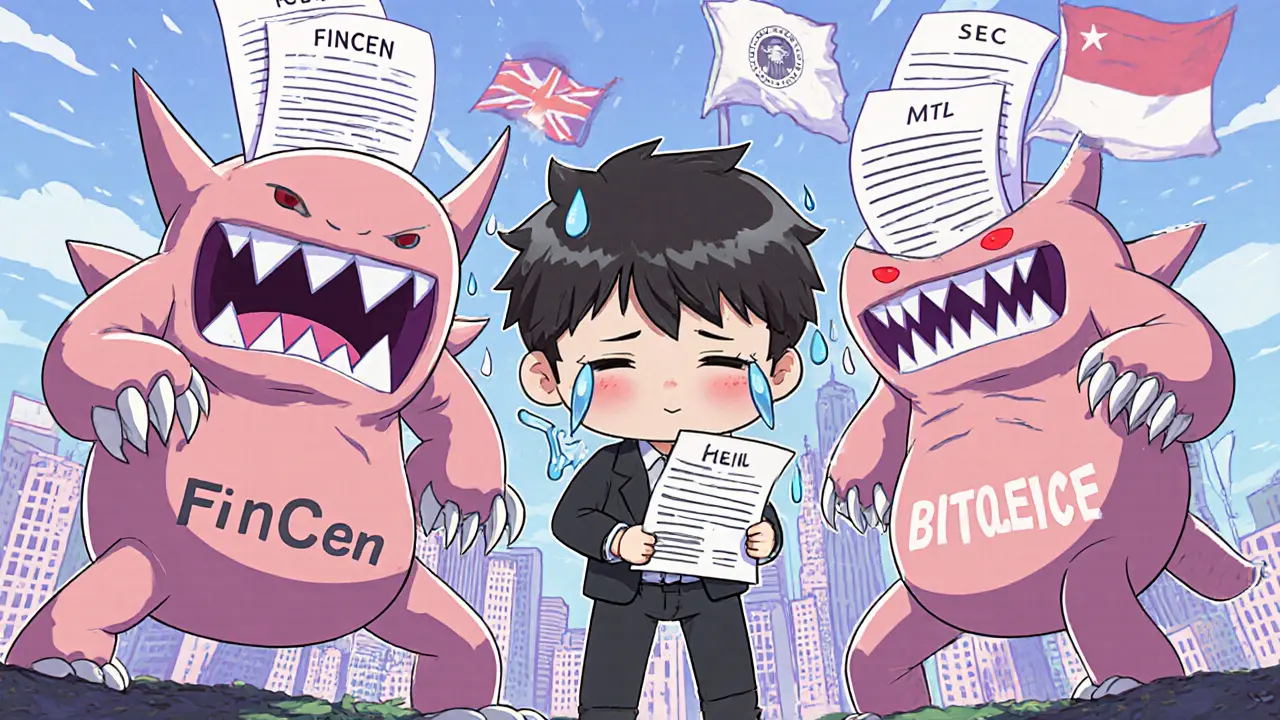

When you run a business involving crypto business license, a legal permit required to offer cryptocurrency services like trading, custody, or exchange in regulated jurisdictions. Also known as cryptocurrency business permit, it’s not optional in places like the U.S., EU, Japan, or Singapore—if you’re handling money or assets, regulators expect you to be registered. Without one, you’re not just breaking rules—you’re exposing yourself to fines, asset seizures, or even criminal charges.

Many people think crypto is lawless, but that’s outdated. Countries have built entire frameworks around crypto regulations, government rules that define how digital assets can be bought, sold, taxed, and stored. For example, the U.S. requires money transmitter licenses for crypto exchanges, while the EU’s MiCA law now forces all major platforms to meet strict transparency and security standards. Even in places like Egypt or Iran, where trading is restricted, crypto compliance, the process of following legal and financial reporting rules to avoid penalties is becoming mandatory for banks and payment processors to monitor transactions.

If you’re thinking of launching a crypto service—whether it’s a P2P platform, a wallet provider, or a DeFi app—you can’t ignore crypto exchange legal, the legal requirements that govern platforms enabling buying, selling, or trading of digital currencies. You need to know where you’re operating, who regulates you, and what documents you must submit. Some licenses cost tens of thousands of dollars and take months to get. Others, like in certain U.S. states, require bonding, audits, and ongoing reporting. The ones that skip this? They vanish when regulators crack down.

You’ll see this play out in the posts below. Some cover how traders in Iran use VPNs to bypass restrictions—risking detection because they’re operating without legal cover. Others show how exchanges like Binance restrict services in over 70 countries because they don’t hold local licenses. There are deep dives into platforms that claim to be "no KYC" but still face legal pressure. And there’s the reality check: most crypto tokens with no clear use case—like Lucidum Coin or ArbiDex—are ignored by regulators not because they’re safe, but because they’re too small to matter. But if you’re building a business, size doesn’t matter. Compliance does.

There’s no magic shortcut. No gray zone that lasts forever. The crypto business license isn’t a hurdle—it’s the foundation. The posts here don’t just list tools or coins. They show you where the lines are drawn, who’s getting caught, and how to stay on the right side of the law. Whether you’re a trader, a founder, or just trying to understand why your favorite platform vanished overnight, this collection gives you the real context behind the headlines.