DueDEX Crypto Exchange: What It Is, How It Works, and Alternatives

When you hear DueDEX, a decentralized crypto exchange focused on perpetual futures trading with low fees and non-custodial control. Also known as DueDEX DEX, it’s one of many platforms trying to give traders direct access to leveraged crypto markets without handing over their keys. But unlike big names like Binance or Coinbase, DueDEX doesn’t have a mobile app, limited fiat support, or a big user base. It’s a niche tool for experienced traders who care more about control than convenience.

DueDEX runs on the Arbitrum, a Layer 2 scaling solution for Ethereum that reduces transaction costs and speeds up confirmations. Also known as Arbitrum One, it lets DueDEX offer trades with near-instant settlement and gas fees under a dollar. That’s a big deal if you’re trading futures every day. But here’s the catch: DueDEX has tiny trading volume compared to top DEXs like Uniswap or dYdX. Most of its liquidity comes from a few large positions, which means slippage can spike during volatile moves. If you’re looking for deep markets, you’ll find better options elsewhere.

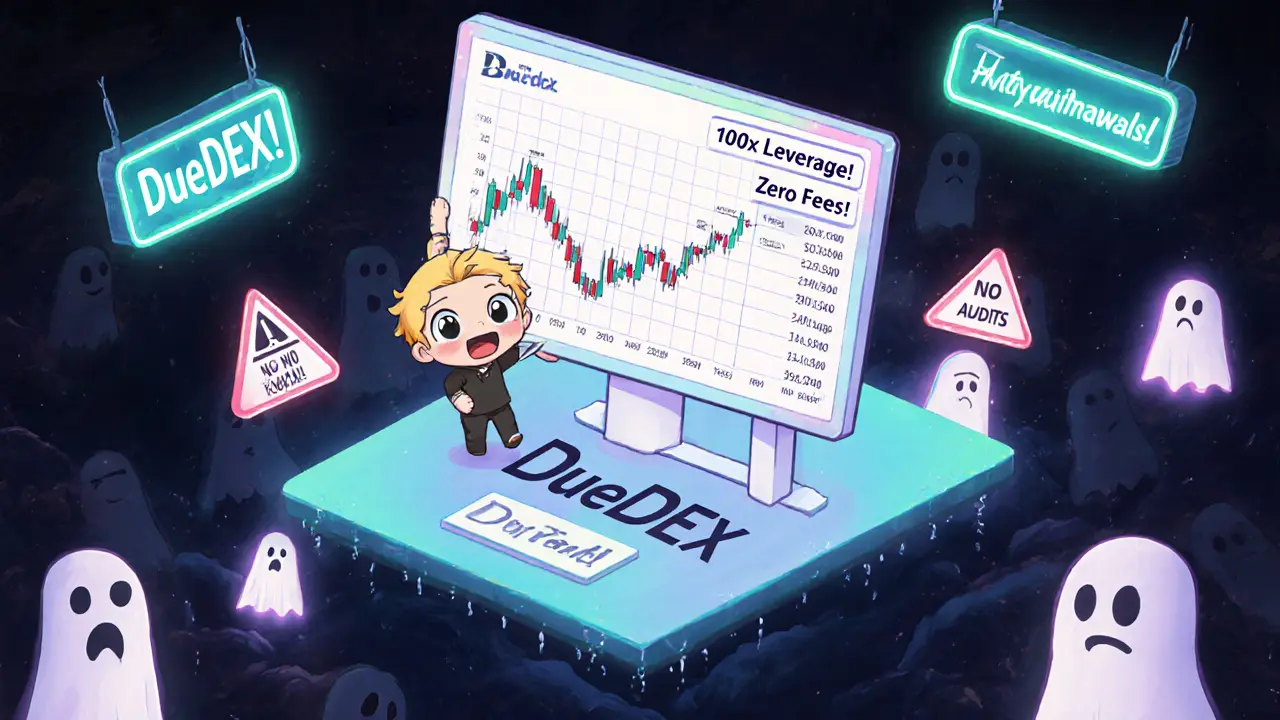

What about decentralized exchange, a platform where users trade crypto directly from their wallets without a central authority holding their funds. Also known as DEX, it’s the backbone of DeFi? DueDEX fits the definition, but it’s not the only one. Platforms like Uniswap and dYdX offer more liquidity, better UIs, and active communities. DueDEX feels like a prototype—functional, but not polished. It’s not a scam, but it’s not a go-to either. If you’re testing new DEXs, try it with small amounts. If you’re serious about trading, look at exchanges with real volume and support.

The posts below dive into other crypto exchanges that actually move the needle—some with real users, others that look promising but turn out to be ghosts. You’ll find reviews of Nexus Trade, Wagmi on zkSync, HTX Indonesia, and more. These aren’t just names on a list. They’re real platforms with real risks, real fees, and real trade-offs. Whether you’re hunting for low-cost spot trading, leveraged DEXs, or hidden gems on Layer 2, you’ll see what works and what doesn’t. No fluff. Just what traders actually need to know before they click ‘buy’.