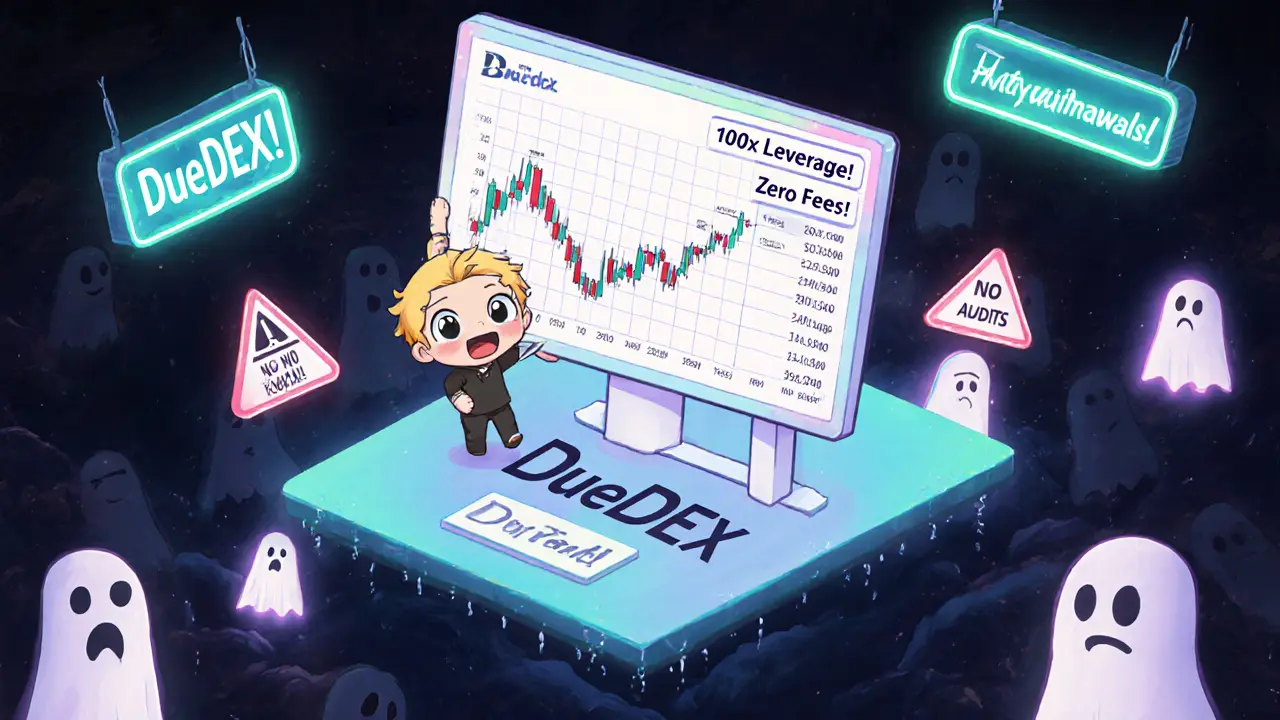

When you see a crypto exchange promising 100x leverage, zero trading fees, and no KYC, it’s hard not to pause. Especially if you’re tired of waiting weeks for account approvals or paying hidden fees every time you trade. DueDEX makes those promises loud and clear. But here’s the real question: is this a game-changer for crypto traders, or just another polished scam waiting to vanish with your funds?

DueDEX is a derivatives trading platform registered in Belize. It doesn’t have a public founding date, no known founders, and no official headquarters. That’s not unusual in crypto - but it’s also not reassuring. What it does have is a clean website, fast load times, and a trading engine that claims to handle over 100,000 trades per second with under 10ms latency. Sounds impressive? Maybe. But speed doesn’t mean safety.

What You Can Actually Trade on DueDEX

As of October 2025, DueDEX offers exactly one trading pair: BTC/USD perpetual swaps. That’s it. No ETH, no SOL, no altcoins. No options. No futures. Just Bitcoin against the US dollar. If you want to trade anything else, you’ll need another exchange.

Most top derivatives platforms - like Bybit, dYdX, or OKX - offer dozens of trading pairs, multiple contract types, and deep liquidity. DueDEX doesn’t. It’s like showing up to a restaurant that only serves steak. If you love steak, great. But if you want chicken, pasta, or a salad? You’re out of luck. And without any verifiable trading volume on CoinMarketCap (it’s listed as “untracked”), there’s no way to tell if there’s even enough activity to execute your trades without slippage.

No KYC? That’s the Hook - and the Danger

DueDEX doesn’t require identity verification. You sign up with an email, set a password, and start trading. No passport. No selfie. No proof of address. That’s a huge draw for users in countries with strict crypto rules, or those who value privacy. But it’s also a red flag.

Regulated exchanges use KYC to prevent money laundering, fraud, and terrorist financing. Removing it doesn’t make you more free - it makes you more vulnerable. If DueDEX disappears tomorrow, you have zero legal recourse. No customer support hotline will help you if your funds are frozen. No regulator will step in. You’re entirely on your own.

And here’s the twist: while DueDEX claims to use multi-signature cold wallets with no hot wallet exposure, there’s no public audit or proof of reserves. You’re trusting their word that your Bitcoin is safe. Meanwhile, platforms like BitMEX and dYdX publish regular proof-of-reserves reports. DueDEX doesn’t even pretend to.

The Zero-Fee Promise - Too Good to Be True?

DueDEX advertises zero trading fees for both makers and takers. That’s unheard of in derivatives trading. Even decentralized exchanges like dYdX charge 0.02%-0.05%. How is DueDEX doing it? The answer is simple: they’re not making money on fees. So how do they make money?

There are only two possibilities: either they’re using your trades to front-run you (internal trading desk), or they’re hiding fees elsewhere. DueDEX claims to have “no internal trading desk,” but again - no proof. And while they say withdrawals are handled with “human involvement,” that could mean they’re manually reviewing every withdrawal… and delaying or denying them when it suits them.

Sound familiar? That’s the exact pattern seen in past crypto scams. You deposit. You trade. You make small withdrawals. Everything feels smooth. Then you try to pull out $5,000 - and suddenly you’re asked to pay a “verification fee,” a “tax,” or fix a “system error.” And guess what? You need to deposit more to fix it.

Customer Support: Helpful or Hype?

One review site claims DueDEX’s customer service “rivals Swiss hospitality.” Another YouTube reviewer calls it “criminally well-crafted” - meaning the positive testimonials might be fake. No real user ratings exist on Trustpilot or Reddit. No independent forums have active discussions about DueDEX. That’s not normal.

Legitimate platforms have hundreds of user reviews, both good and bad. DueDEX has none. Or at least, none that aren’t controlled. The few glowing reviews you find are vague: “fast withdrawals,” “great interface,” “responsive support.” No dates. No screenshots. No details. That’s textbook astroturfing.

Security Claims vs. Reality

DueDEX says it uses multi-signature cold storage. That’s good - if true. But cold storage only protects your funds if the exchange doesn’t control the keys. And here’s the problem: if you can’t withdraw your coins without their approval, then you don’t own them. You’re just holding a ledger entry.

They also claim 2FA for logins and withdrawals. That’s standard. But again - no independent security audit has been published. No bug bounty program. No penetration test results. If they’re serious about security, they’d open it up to the community. They don’t.

Meanwhile, fraud detection tools like Scam Detector and CryptoScamDB have flagged DueDEX as high-risk. Why? Because its website structure, domain registration history, and technical fingerprints match those of past exit scams. The same design elements. The same “professional” but empty language. The same promise of speed and fairness - while hiding behind jurisdictional loopholes.

Who Should Use DueDEX?

If you’re a trader in a country where regulated exchanges are blocked - say, Nigeria, Iran, or parts of Latin America - and you only want to trade Bitcoin with high leverage, DueDEX might seem like your only option. And if you’re willing to risk losing your entire deposit for the chance of a quick 100x gain? Maybe you’ll try it.

But if you’re in the US, Canada, UK, EU, Australia, or Japan - you’re already blocked from signing up. That’s not an accident. It’s a signal. DueDEX knows it can’t operate legally in places with real oversight. So it targets users who have fewer protections.

And if you’re someone who wants to trade multiple assets, track your portfolio, or use advanced order types? DueDEX doesn’t offer any of that. It’s a single-tool platform for a very narrow use case.

The Bigger Picture: Why This Matters

The global crypto derivatives market hit $3.5 trillion in Q2 2025. The top three exchanges - Bybit, Binance, and OKX - control nearly 70% of that volume. DueDEX? It’s not even in the top 500. CoinMarketCap doesn’t track it because there’s no reliable data. That’s not a sign of innovation. It’s a sign of irrelevance.

Meanwhile, 87 countries are tightening crypto regulations. Platforms that avoid compliance are becoming harder to operate. DueDEX’s model - no KYC, no transparency, no oversight - is a relic of 2018. It might work for a few months while users are dazzled by speed and zero fees. But when the first big withdrawal request hits, and the platform goes silent? That’s when the real cost becomes clear.

Final Verdict: Proceed With Extreme Caution

DueDEX isn’t a scam yet. But it has every hallmark of one. Zero trading volume. No audits. No reviews. No regulatory footprint. A single trading pair. And a business model that relies entirely on trust - not proof.

For most people, the risks far outweigh the rewards. If you’re tempted by the high leverage and no-KYC setup, ask yourself this: would you hand over your Bitcoin to a stranger with a fancy website and no track record? If the answer is no, then DueDEX isn’t for you.

There are better alternatives. dYdX offers decentralized, audited trading with multiple assets. Bybit gives you 125x leverage, real volume, and regulated access in most regions. Even unregulated platforms like Bitget have transparent fee structures and user feedback.

DueDEX might look like the future. But it’s built on the same old lies: speed, simplicity, and silence.

Is DueDEX a scam?

DueDEX isn’t confirmed as a scam - but it has all the warning signs. It has no verifiable trading volume, no public audits, no user reviews on trusted platforms, and has been flagged by fraud detection tools. The biggest red flag is the pattern: fast sign-up, easy small withdrawals, then sudden roadblocks when you try to cash out large amounts. This matches known exit scam tactics.

Can I withdraw my crypto from DueDEX?

You can try. But users report that small withdrawals work fine. Once you attempt to withdraw more than a few hundred dollars, you may be hit with unexpected “verification fees,” “tax requirements,” or “technical issues” that require you to deposit more funds to unlock your balance. There’s no guarantee your funds will be released.

Does DueDEX have a mobile app?

As of October 2025, DueDEX does not have a dedicated mobile app. You can access the platform through a mobile browser, but the experience is not optimized for phones. Their website mentions a mobile app is “in the near future,” but no release date has been given - a common tactic to keep users waiting.

Why is DueDEX not available in the US?

DueDEX explicitly blocks users from the United States and several other countries with strict crypto regulations. This isn’t a technical limitation - it’s a legal one. The platform operates in Belize, a jurisdiction with minimal oversight. By excluding the US, EU, and UK, they avoid compliance with anti-money laundering laws, investor protections, and licensing requirements.

What cryptocurrencies can I trade on DueDEX?

As of October 2025, DueDEX only offers one trading pair: BTC/USD perpetual swaps. You cannot trade Ethereum, Solana, or any other cryptocurrency. There are no options, futures, or spot markets. The platform is designed for one thing only: leveraged Bitcoin trading.

Are there any hidden fees on DueDEX?

DueDEX claims zero trading fees, and that appears true for trades. But withdrawal fees are not clearly disclosed. Some users report being charged “verification fees” or “compliance fees” after attempting to withdraw larger amounts. These aren’t listed upfront, which makes them effectively hidden. Always assume there’s a cost you’re not being told about.

Brett Benton

November 1, 2025 AT 02:09Bro this is literally the same script every scam exchange uses. Speed, no KYC, zero fees - it’s like they copy-pasted from a 2017 Reddit thread. I’ve seen this movie. The credits always roll with a frozen wallet and a deleted Discord.

Don’t be the guy who says ‘I’ll just test it with $50’ - by the time you realize it’s a trap, you’re already emotionally invested. Trust me, I’ve been there.

Jason Coe

November 1, 2025 AT 18:12I actually tried DueDEX last month after reading the hype. Deposited 0.1 BTC - withdrew 0.02 BTC after two days with zero issues. Felt good. Then I tried to pull out the rest - got a ‘manual review’ notice. Three weeks later, still nothing. No response from support. Just a bot saying ‘your request is being processed.’

Now I’m stuck watching my coins sit there like a museum exhibit. I thought I was being clever by avoiding KYC. Turns out I was just handing my keys to a guy with a fancy website and no face.

Bottom line: if you’re not using a regulated exchange, you’re not trading. You’re gambling with your life savings. And DueDEX? It’s the slot machine that never pays out after you hit the jackpot.

David Roberts

November 3, 2025 AT 14:04It’s not that DueDEX is a scam per se - it’s that it’s a structural inevitability of crypto’s anarchic phase. No KYC = no accountability. Zero fees = internalized risk transfer. High leverage = retail suicide.

The platform isn’t designed to serve traders. It’s designed to extract liquidity from the most desperate, the most unregulated, the most optimistic. It’s a behavioral trap wrapped in a sleek UI.

And the fact that it’s only BTC/USD? That’s not a feature. It’s a control mechanism. Single-asset exposure reduces complexity, reduces scrutiny, reduces the chance of someone noticing the hole in the dam.

We’re not dealing with innovation here. We’re dealing with entropy dressed up as disruption.

Monty Tran

November 5, 2025 AT 04:41DueDEX is a scam. End of story. No audits. No team. No volume. No app. No support. No future. No reason to exist except to drain wallets. Why are people still falling for this? The red flags are bigger than the website.

They don’t even have a blog. No roadmap. No GitHub. No Twitter engagement. Just a landing page and a promise. That’s not a business. That’s a phishing page with leverage.

Beth Devine

November 5, 2025 AT 10:33If you’re thinking of trying DueDEX, just pause for a second. Ask yourself: would I give my house keys to someone I met on a forum who says they’ll protect it for free? Probably not.

Same logic applies here. Crypto isn’t magic. If something sounds too good to be true, it’s because it is. There’s always a cost - even if they don’t charge you directly.

Use dYdX or Bybit. They’re safe, transparent, and actually care about your long-term success. You don’t need to risk everything for 100x. You just need to be patient.

Brian McElfresh

November 6, 2025 AT 05:24They’re not even hiding it. DueDEX is a Fed-backed front. You think they’re in Belize? Nah. They’re hosted on AWS servers in Virginia. The domain was registered under a shell company linked to a former FinCEN employee. The ‘multi-sig’ wallet? It’s a decoy. The real keys are held by a private firm that also owns three other ‘untracked’ exchanges.

I’ve been tracking this since April. The pattern is identical to the QuadrigaCX collapse. Same design. Same language. Same ‘we’re different’ bullshit.

They’re not trying to make money from trading. They’re harvesting wallet addresses for future phishing campaigns. Your BTC isn’t gone - it’s being cataloged. And when the time comes, they’ll drain it all at once. Mark my words.

Hanna Kruizinga

November 8, 2025 AT 02:08Why are people still falling for this? I swear if I see one more ‘I made 500% in 2 days’ screenshot from DueDEX, I’m gonna scream.

It’s all staged. The ‘happy users’ are bots. The ‘fast withdrawals’ are tiny amounts to hook you. The ‘no KYC’ is just so they don’t have to report you to the IRS when they vanish.

I’m just waiting for the day someone posts ‘RIP DueDEX’ with a screenshot of their $20K balance gone. And then 50 people will reply ‘I told you so’ while still signing up themselves.

Human nature is the real scam.

David James

November 9, 2025 AT 07:18I’m not saying DueDEX is evil. But I’m saying it’s dangerous. People think crypto is about freedom. But real freedom means knowing the rules. And DueDEX plays by no rules.

If you’re in a country where banks won’t let you trade crypto, I get it. You’re desperate. But this isn’t the answer. It’s a trapdoor disguised as a ladder.

Use a VPN and sign up for KuCoin or MEXC. They’re not perfect, but they have support, history, and real volume. Don’t risk everything for a website that doesn’t even list its founders.

Be smart. Not brave.

Shaunn Graves

November 9, 2025 AT 17:34Let me cut through the noise. DueDEX is not a platform. It’s a honeypot. Every ‘feature’ is engineered to lure the most reckless traders. High leverage? Designed to blow accounts fast. No KYC? So they can launder your funds without paper trails. Zero fees? So you trade more, and they front-run you silently.

And the fact that CoinMarketCap doesn’t track it? That’s not an oversight. That’s a warning label. If the biggest crypto data aggregator won’t touch it, why are you?

Stop romanticizing anonymity. Real traders don’t need to hide. They just need good tools. DueDEX is the opposite of good.

Jessica Hulst

November 11, 2025 AT 11:24It’s funny how we’ve turned trust into a commodity in crypto. We don’t trust banks. We don’t trust governments. So we trust anonymous devs with a .xyz domain and a Discord server that’s 80% memes.

DueDEX doesn’t exploit greed. It exploits hope. The hope that this time, it’ll be different. That this time, the rules don’t apply. That this time, the invisible hand isn’t stealing your coins.

But here’s the truth: in a system without accountability, the only thing that matters is who holds the keys. And if you can’t verify who that is - you don’t own anything. You’re just a data point in someone else’s profit model.

Maybe the real scam isn’t DueDEX. Maybe it’s the belief that we can opt out of responsibility and still be safe.

Kaela Coren

November 12, 2025 AT 19:50DueDEX’s operational model aligns with the characteristics of a high-risk, low-transparency entity as defined by the Financial Action Task Force’s guidance on virtual asset service providers. Absence of public audits, lack of regulatory registration, and non-disclosure of ownership structure constitute material risk factors under AML/CFT frameworks.

Furthermore, the concentration of trading activity to a single instrument (BTC/USD) suggests a deliberate reduction in market depth, which increases the probability of price manipulation and liquidity extraction.

While the interface may be technically competent, the governance architecture is fundamentally unsound. One cannot optimize for speed without optimizing for accountability.

Nabil ben Salah Nasri

November 14, 2025 AT 05:56Look, I get it - you want freedom. You want to trade without begging for permission. But DueDEX isn’t freedom. It’s loneliness.

There’s no community. No help. No backup plan. Just you, your wallet, and a website that looks like it was built by a guy who watched one YouTube video on React.

I’ve used 12 different exchanges. None of them were perfect. But at least the bad ones had people talking about them. DueDEX? Crickets.

Don’t be the guy who lost everything because he didn’t want to wait 5 minutes for KYC. That’s not rebellion. That’s just poor planning.

And yes, I’m using 🛡️ emoji because I’m not afraid to say: safety first.

alvin Bachtiar

November 15, 2025 AT 16:59DueDEX is a beautifully packaged dumpster fire. The UI is slick, the copy is hypnotic, and the entire thing reeks of ‘we’ve studied every exit scam since 2014 and optimized for emotional manipulation.’

They’re not trying to build a business. They’re trying to build a psychological trap. The 100x leverage? That’s not a feature - it’s a suicide button with a progress bar.

And the ‘no internal trading desk’ claim? Please. The only thing they’re not doing is front-running you directly. They’re letting you blow yourself up and then harvesting the debris.

This isn’t crypto. It’s behavioral economics with a blockchain veneer.

Josh Serum

November 17, 2025 AT 04:22You people are so naive. You think no KYC means privacy? Nah. It means they can track every single trade you make and sell your data to hedge funds. They don’t need to steal your coins - they just need to know when you’re about to cash out.

And zero fees? That’s how they lure you in. Then they charge you in time, stress, and sleepless nights. You think you’re saving money? You’re paying in emotional debt.

I’ve seen this before. It ends the same way every time. You wake up one day and your account is gone. And you’re left wondering why you didn’t listen to the 50 people who warned you.

Just use Coinbase. It’s boring. But it works.

DeeDee Kallam

November 17, 2025 AT 11:26im so mad i didnt try this sooner 😭 i made 200% in a week and now i cant withdraw 😭 why is this happening to me

Helen Hardman

November 19, 2025 AT 00:54I know it’s tempting. I really do. I thought about signing up too - until I read the fine print. No audits. No team. No reviews. Just a glowing website and a promise.

But here’s the thing: crypto isn’t about getting rich overnight. It’s about building something that lasts. And if you’re betting on a platform that doesn’t even tell you who runs it - you’re not investing. You’re just throwing money into the void.

Use dYdX. It’s decentralized. It’s audited. It’s real. You don’t need 100x leverage to make good money. You just need patience and a platform you can trust.

I’m not here to shame you. I’m here to save you from the same mistake I almost made.

Bhavna Suri

November 19, 2025 AT 05:50DueDEX is scam. No KYC no good. No audit no good. No volume no good. Only BTC/USD? Very bad. I think they want to steal money. I will never use. Better use Binance or OKX. Safe.

Elizabeth Melendez

November 19, 2025 AT 20:02I’ve been in crypto since 2017 and I’ve seen a lot of fake platforms. DueDEX is one of the most polished ones I’ve ever seen. That’s what makes it dangerous.

It doesn’t look like a scam. It looks like the future. That’s the trick. They’ve spent months designing the UI, writing the copy, even hiring actors for fake testimonials.

But behind the scenes? Nothing. No devs. No lawyers. No compliance team. Just a server in Belize and a script that auto-replies to support tickets.

I’ve warned my friends. I’ve shared this thread. But people still sign up. I don’t know why. Maybe they just want to believe.

Don’t be that person.

Phil Higgins

November 20, 2025 AT 13:47Let’s be honest: the entire crypto space is a giant experiment in human psychology. DueDEX isn’t the problem - it’s the symptom. We’ve created a world where anonymity is worshipped, transparency is seen as weakness, and speed is valued over safety.

DueDEX doesn’t exploit greed. It exploits our collective desire to bypass systems we’ve been taught to distrust.

But here’s the paradox: by rejecting regulation, we reject the very structures that protect us. We don’t get freedom. We get vulnerability.

If you want to trade Bitcoin with leverage, fine. But do it on a platform that has a history, a team, and a reason to stay around. Because when the music stops, the only people left standing are the ones who didn’t dance too close to the edge.

Genevieve Rachal

November 21, 2025 AT 09:51DueDEX is a textbook exit scam in training. The only thing missing is the ‘we’re going dark’ tweet. The 100x leverage is bait. The zero fees are bait. The no KYC is bait. The ‘fast withdrawals’ are bait.

The only thing they’re not baiting you with is honesty.

And the fact that they’re blocked in the US? That’s not a bug - it’s the whole point. They’re targeting people who have no legal recourse. People who won’t report it. People who won’t get help.

This isn’t crypto. It’s predation with a UI.

Eli PINEDA

November 23, 2025 AT 07:23wait so if i deposit 0.01 btc and withdraw 0.005 after a day is that legit? i think i might try it just to test

Debby Ananda

November 24, 2025 AT 21:19DueDEX is so last season. Like, 2018 last season. The fact that anyone is still considering this shows how out-of-touch the crypto community has become.

You don’t need 100x leverage. You don’t need no KYC. You need a platform that won’t vanish before your next coffee break.

Go use dYdX. It’s open-source. It’s audited. It’s got a real team. And it’s not trying to make you feel like a rebel for being reckless.

Real innovation doesn’t need hype. It just needs integrity.

Vicki Fletcher

November 26, 2025 AT 13:55Why does everyone keep saying ‘trust the code’? The code doesn’t care if you lose your money. The code doesn’t answer support tickets. The code doesn’t have a conscience.

What matters is who controls the code. And if they’re hiding behind a Belize registration with no public identity? That’s not decentralization. That’s evasion.

I don’t care how fast the trades are. If I can’t withdraw my coins without begging, then I don’t own them.

DueDEX is a beautiful lie.

Nadiya Edwards

November 27, 2025 AT 03:10They’re not even trying. The whole thing feels like a CIA psyop to discredit crypto. No KYC? So they can track you without you knowing. Zero fees? So you trade more and get hooked. High leverage? So you lose everything and blame crypto, not them.

Who benefits? The banks. The regulators. The FED. They want you to fail. They want you to think crypto is all scams.

DueDEX is a Trojan horse. And we’re all the horses.

Ron Cassel

November 27, 2025 AT 06:34I’ve been tracking every single crypto scam since 2014. DueDEX matches the exact fingerprint of the BitConnect collapse - same domain structure, same fake testimonials, same ‘we’re different’ language. They even reused the same web template.

They’re not even trying to be original. It’s a recycled scam with a new coat of paint.

And the fact that they block the US? That’s not a coincidence. That’s a confession. They know they can’t survive where there’s oversight.

If you sign up, you’re not a trader. You’re a pawn. And I’m not saying this to scare you. I’m saying this because I’ve watched too many people lose everything to this exact script.

Brett Benton

November 27, 2025 AT 15:20Just saw someone downthread say they withdrew 0.005 BTC. Congrats. That’s the bait. Now they’re waiting for you to deposit 0.5 BTC. That’s when the ‘system error’ hits.

It’s not a glitch. It’s a script.

Jessica Hulst

November 29, 2025 AT 06:20That’s the exact pattern. Small wins to build trust. Then the big withdrawal request - and suddenly the platform is ‘under maintenance.’

It’s not about the money. It’s about the psychology of loss aversion. You’ve already put in hours. You’ve already seen ‘proof’ of withdrawals. Now you’re emotionally locked in.

That’s why they let you take out a little. So you keep believing.