DueDEX Scam: What Happened and How to Avoid Fake Crypto Exchanges

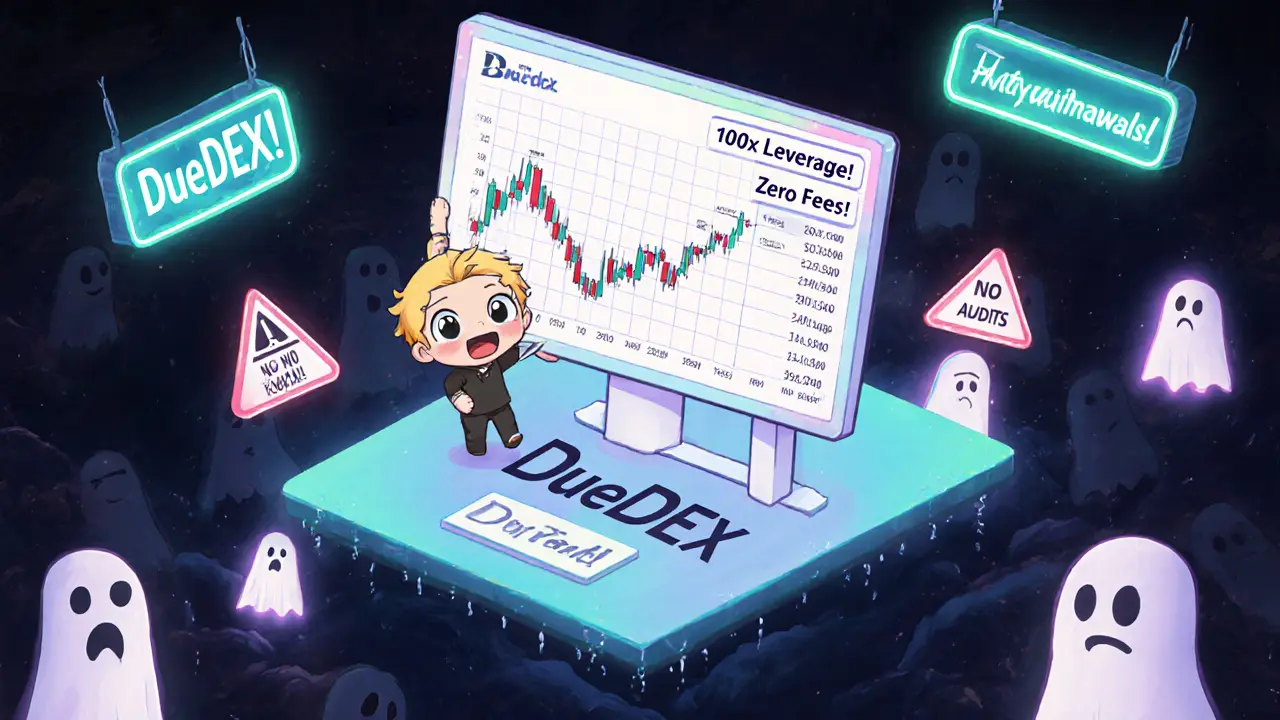

When people talk about the DueDEX scam, a deceptive decentralized exchange that vanished after collecting user funds without delivering any trading service. It's not just another failed project—it's a textbook example of how fake crypto exchanges exploit trust in DeFi. Unlike real DEXs like Uniswap or PancakeSwap, DueDEX had no code audit, no team transparency, and no on-chain activity after the launch. It looked like a working exchange, but behind the interface was a smart contract designed to lock user deposits forever.

What made the DueDEX scam, a deceptive decentralized exchange that vanished after collecting user funds without delivering any trading service. It's not just another failed project—it's a textbook example of how fake crypto exchanges exploit trust in DeFi. so dangerous was how it copied real platforms. It used similar UI elements, fake trading volume numbers, and even cloned documentation from legitimate projects. Users thought they were trading on a new DeFi hub, but their funds went straight into a wallet controlled by anonymous developers who disappeared within days. This isn’t rare. Similar scams like ArbiDex Token (ARX), a low-liquidity crypto token on Arbitrum with almost no trading volume and zero community support and Wagmi (zkSync Era), a DeFi protocol with minimal trading volume and no transparency follow the same pattern: low liquidity, no team, no audits, and a sudden vanish.

The DueDEX scam didn’t just steal money—it damaged trust in the whole DeFi space. Many new users now hesitate to try even legitimate DEXs because they fear another trap. But the fix isn’t avoiding DeFi altogether. It’s learning how to spot the red flags: no team info, no smart contract audit, fake social media followers, and tokens with zero real trading volume. If a platform promises high yields with no risk, it’s not a feature—it’s a warning. The posts below break down exactly how these scams work, what they look like, and how to protect yourself before you send your first dollar.