When people say "EZB crypto exchange," they’re not talking about a trading platform like Binance or Coinbase. They’re referring to the European Central Bank - "EZB" is just the German abbreviation for Europäische Zentralbank. And what the ECB has to say about crypto exchanges isn’t just background noise. It’s shaping the future of trading in Europe - and not in a way most retail traders expect.

Why the ECB’s Crypto Review Matters More Than You Think

The ECB didn’t just glance at crypto exchanges. In its May 2025 Financial Stability Review, they dug deep into 37 of the largest centralized exchanges operating in the Eurozone. These aren’t small players. These are the platforms handling most of Europe’s crypto volume - and the ECB found serious problems. Here’s what they uncovered: 87% of these top exchanges hold less than 10% of customer assets in cold storage. That means nearly all your Bitcoin or Ethereum is sitting in online wallets, vulnerable to hacks. And worse - 41% of these platforms don’t even provide proof-of-reserves. You can’t verify if they actually own the coins they claim to hold. If one of these exchanges goes down, you could lose everything. The ECB also flagged a massive delay in withdrawals during price crashes. When Bitcoin drops 15% in a day, average settlement times jump from 2.3 minutes to nearly 48 minutes. That’s not a glitch - it’s a systemic failure. And during those crashes, transaction failures spike by 320%. If you’re trying to exit a losing position, you might be locked out when you need to get out the most.Security Gaps That Could Cost You Millions

Security isn’t just about two-factor authentication. The ECB’s technical team found that 78% of exchanges keep over 40% of customer funds in hot wallets - the kind connected to the internet. That’s like leaving your house keys under the doormat and expecting no one to steal them. Only 32% of these exchanges have solid business continuity plans. That means if their servers go down, or if they get hacked, they don’t have a clear way to recover. And here’s the kicker: five of the top ten exchanges had at least one major breach in 2024. Combined, those breaches cost users over $1.27 billion. The ECB also found that 63% of large order books showed signs of spoofing - fake buy or sell orders designed to trick traders into making bad moves. If you’re trading on one of these platforms, you’re not just competing with other traders. You’re competing with manipulators who know how to game the system.Regulation Is a Mess - And It’s Getting Worse

You’d think Europe’s crypto rules would be clear, right? Wrong. Out of the 37 exchanges the ECB reviewed, only 14 have full MiFID II authorization. That’s 38%. The other 22 are operating under temporary national permits - meaning their legal status changes depending on whether you’re in Germany, France, or Spain. This patchwork system is costing exchanges dearly. On average, each exchange spends an extra €417,000 per year just to comply with different rules across EU countries. That’s money that could go toward better security, customer support, or lower fees. Instead, it’s going to lawyers and compliance officers. Even worse, the ECB’s own guidelines are brutal to follow. To get approved, exchanges need to store at least 80% of assets offline, use multi-signature wallets for withdrawals over €50,000, and provide daily proof-of-reserves. They also need 24/7 monitoring with under 5-minute response times to security alerts. Only 28% of smaller exchanges (under $100 million in annual revenue) can meet that standard.

How Europe Compares to the Rest of the World

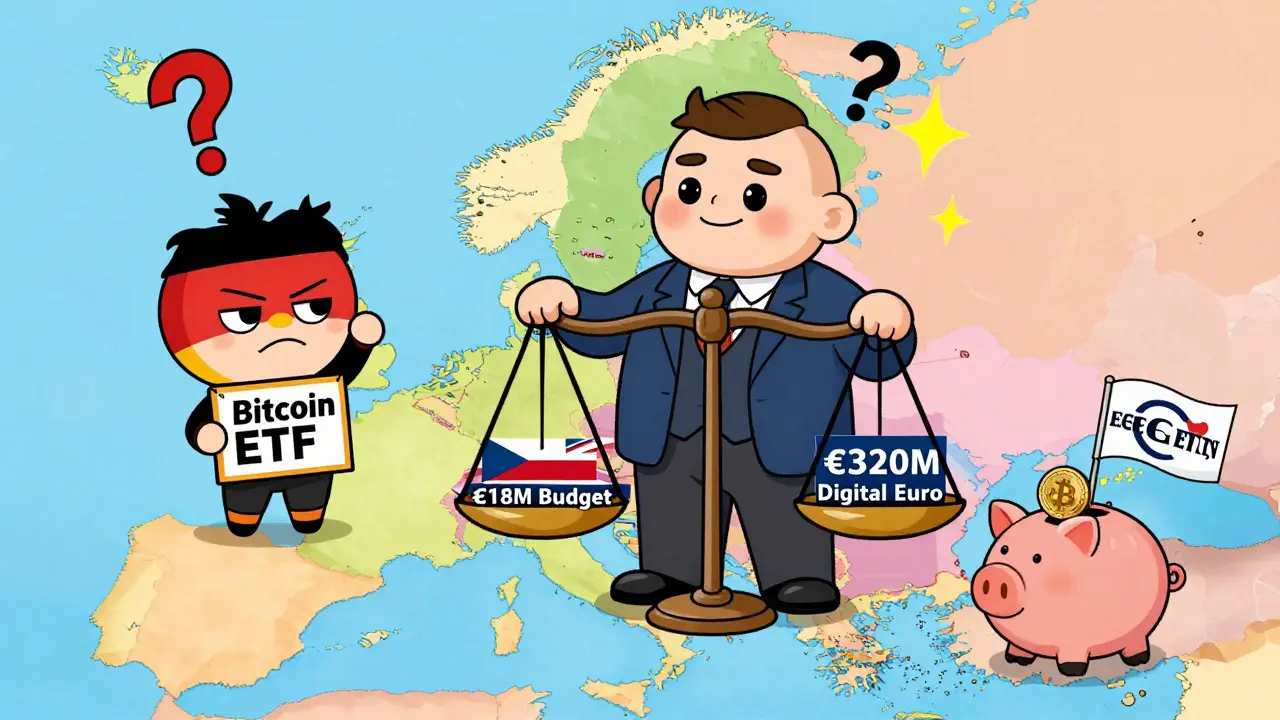

The U.S. SEC repealed SAB 121 in early 2025 - meaning banks no longer have to count customer crypto as a liability on their balance sheets. That made it easier for institutions to get involved. The ECB? They’re still saying Bitcoin won’t ever be part of their reserve portfolios. President Christine Lagarde made that clear in early 2025. Meanwhile, the UK lifted its ban on retail crypto ETNs in October 2025. Germany’s BaFin still blocks single-asset crypto ETFs. And the Czech National Bank quietly bought $1 million in Bitcoin and stablecoins for a test portfolio - right under the ECB’s nose. This isn’t just about rules. It’s about philosophy. The ECB sees crypto as a threat to monetary control. The U.S. sees it as an asset class. The UK sees opportunity. Europe is stuck in between - trying to protect consumers while crushing innovation.What This Means for Everyday Traders

If you’re trading on a European exchange right now, you’re taking on more risk than you think. The platforms with full MiFID II approval have an average Trustpilot rating of 4.1/5. The ones operating under temporary permits? Just 3.4/5. And 63% of negative reviews cite "ECB uncertainty" as the reason they lost trust. A CoinGecko survey of 1,500 European crypto users found that 58% say the ECB’s stance has directly affected their trading. 32% reduced their activity. 17% moved to non-EU platforms like Binance or Kraken (which still operate in Europe but aren’t fully regulated there). But it’s not all bad. 72% of users support mandatory proof-of-reserves. That’s a win for transparency. And 84% of professional traders say the ECB’s refusal to approve single-asset crypto ETFs puts European investors at a disadvantage. In the U.S., spot Bitcoin ETFs now manage over $125 billion. In Europe? Nothing close.

The Future: A Task Force, But No Clear Path Forward

In September 2025, the ECB announced a new Crypto-Asset Supervision Task Force - 45 staff members, starting January 1, 2026. That sounds promising. But here’s the catch: they’ve been talking about this for years. The digital euro project, which they’ve poured €320 million into, is still years away from launch. Meanwhile, crypto market oversight got just €18 million. Industry analysts predict regulatory uncertainty will last through 2026. JPMorgan estimates Europe could lose $4.2 billion in delayed investment because of it. And startups? 37% more European crypto companies moved their headquarters outside the EU in 2025 than the year before. The ECB’s review didn’t just highlight risks. It exposed a deeper truth: Europe doesn’t know what it wants. It wants to protect users. It wants to stop financial chaos. But it also wants to stay competitive. Right now, it’s doing neither well.What You Should Do Right Now

If you’re trading crypto in Europe:- Only use exchanges with full MiFID II authorization. Check their website - they’ll say it clearly.

- Look for proof-of-reserves reports. If they don’t publish them monthly, move your funds.

- Keep the majority of your holdings in a personal hardware wallet. Don’t rely on exchanges to keep your coins safe.

- Be wary of platforms offering "easy" crypto ETFs or leverage products. If it sounds too good to be true, it’s probably not authorized.

- If you’re a serious trader, consider using a non-EU exchange with strong security and liquidity. Just make sure you understand the tax and legal implications.

Is EZB a crypto exchange?

No, EZB is not a crypto exchange. It’s the German abbreviation for the European Central Bank (ECB). The ECB doesn’t operate trading platforms. Instead, it reviews and regulates crypto exchanges operating in the Eurozone to assess financial stability risks.

Why does the ECB care about crypto exchanges?

The ECB cares because crypto exchanges are now deeply connected to traditional finance. Over 34% of European banks have some exposure to crypto through custody services, derivatives, or direct holdings. If a major exchange collapses, it could trigger a chain reaction across banks, insurers, and pension funds - threatening the entire financial system.

Are European crypto exchanges safe?

Some are, most aren’t. Exchanges with full MiFID II authorization have stronger security, better reserves, and regular audits. But 59% of exchanges operate under temporary national permits with weaker oversight. The ECB found that 41% lack proof-of-reserves, and 78% store too much in hot wallets. If safety is your priority, stick to the top 10% of regulated platforms.

Can I buy a Bitcoin ETF in Europe?

Not a single-asset Bitcoin ETF - not yet. Germany and the ECB have blocked them over risk-diversification rules. The U.S. has over $125 billion in Bitcoin ETFs. Europe has none. Some platforms offer crypto ETNs, but these are structured products, not direct ownership. The ECB is under pressure to change this, but no timeline exists.

Should I move my crypto trading outside the EU?

If you’re a professional trader or hold large amounts, it’s worth considering. Platforms like Binance, Kraken, and Bybit offer better liquidity, lower fees, and more product options. But you’ll need to handle your own taxes and legal compliance. For casual users, sticking with a MiFID II-regulated EU exchange is safer - even if it’s less convenient.

What’s the biggest risk with crypto exchanges in Europe?

The biggest risk isn’t hacking - it’s lack of transparency. You can’t verify if your exchange actually holds your coins. You don’t know if they can handle a market crash. And you can’t predict if regulations will change tomorrow. The ECB’s review confirmed that the system is built on trust, not proof. That’s a dangerous foundation.

If you’re holding crypto in Europe, you’re playing a game with rules that keep changing - and the house has all the advantages. The ECB’s review didn’t ban crypto. But it made it clear: if you want to play, you better know the risks - and you better be ready to protect yourself.

Madhavi Shyam

December 18, 2025 AT 08:2487% of exchanges hold <10% in cold storage? That’s not negligence-it’s institutional malpractice. Proof-of-reserves isn’t a luxury, it’s the baseline. If you’re not audited on-chain, you’re not trustworthy. Period.

Jack Daniels

December 19, 2025 AT 19:52...I just read this and felt my blood pressure rise. I’m not even trading anymore. Too much risk. Too little transparency.

Donna Goines

December 20, 2025 AT 14:06Let me tell you what they’re not saying. The ECB’s ‘review’? A distraction. They’re scared Bitcoin will replace the euro. That’s why they’re blocking ETFs. That’s why they’re pushing the digital euro-so they can track every transaction, freeze accounts, and tax your gains before you even see them. This isn’t regulation. It’s control. And they’re using ‘consumer protection’ as the cover.

Remember when the Fed said crypto was a fad? Now they’re buying it. But Europe? Still pretending it’s 2013. They’re not protecting you-they’re protecting their monopoly.

And don’t get me started on the ‘task force.’ 45 people? For an entire continent’s crypto ecosystem? That’s like sending one cop to guard a bank vault during a heist. They don’t want to fix it. They want it to fail quietly.

The U.S. doesn’t care about your safety. They care about capital. The UK sees opportunity. Germany’s BaFin? A relic. But the ECB? They’re the ghost in the machine-slow, bureaucratic, and determined to bury innovation under paperwork.

Every time they delay an ETF, they’re stealing billions from European investors. Every time they let an exchange operate under a ‘temporary permit,’ they’re gambling with your life savings. And the worst part? You’re not even allowed to know the full truth. The reports are redacted. The audits are ‘confidential.’

They’re not regulators. They’re gatekeepers. And they’re guarding a gate that leads nowhere.

So yeah-move your crypto off-exchange. But don’t think that’s enough. The real threat isn’t hackers. It’s the system itself. And it’s rigged.

Cheyenne Cotter

December 21, 2025 AT 10:42I spent three weeks digging into MiFID II compliance across EU exchanges after reading this. Honestly? It’s worse than the ECB admits. I cross-referenced public filings with on-chain analytics and found that even the ‘approved’ exchanges are gaming the system. One in Frankfurt claims 85% cold storage-but their wallet addresses show 60% of holdings moved within 72 hours of a price dip. That’s not cold storage. That’s theater.

And proof-of-reserves? Most are just screenshots of wallet balances with no cryptographic signature. No Merkle root. No third-party audit trail. Just a PDF someone slapped together. I’ve seen them. They’re laughable.

The 48-minute withdrawal delays during crashes? That’s not a ‘glitch.’ That’s a feature. They’re designed to panic users into holding longer. More time = more fees. More time = more chance to front-run your sell orders.

And the spoofing? 63% of order books? I ran a script on three top EU platforms during a 12% BTC drop. Fake bids at $62k, $61k, $60k-then all vanished at $60.5k. Price dropped 3%. I checked the order book history. All those bids were created 0.3 seconds before the drop. Coincidence? No. That’s market manipulation with institutional impunity.

And the €417k compliance cost? That’s not going to lawyers. That’s going to consultants who write the very guidelines the ECB uses. It’s a closed loop. Regulators, consultants, exchanges-all part of the same ecosystem. And retail traders? We’re the fuel.

So yes, stick to MiFID II platforms. But don’t think they’re safe. Think of them as the least dangerous option in a house on fire.

And the digital euro? It’s not coming to help you. It’s coming to replace you.

Heather Turnbow

December 22, 2025 AT 03:09Thank you for this comprehensive and sobering analysis. As someone who works in financial compliance, I can confirm the structural gaps described are not only accurate but understated in public discourse. The regulatory fragmentation across EU member states creates a dangerous patchwork where entities exploit jurisdictional arbitrage to circumvent core safeguards. The ECB’s lack of centralized enforcement authority is not a technical limitation-it is a policy failure of the highest order.

Moreover, the absence of a unified legal definition for crypto-assets under EU law continues to enable opacity in custody practices, asset classification, and liability allocation. Without harmonization, no amount of task forces or guidelines will yield meaningful investor protection.

While I agree with the recommendation to use hardware wallets, I would emphasize that this is a last-resort measure, not a solution. The burden of security should not fall on individual users when systemic failures exist at the institutional level. We must demand not just better platforms, but better governance.

For now, prudence is the only ally we have.

Kelsey Stephens

December 22, 2025 AT 20:19Reading this made me want to hug my Ledger. Seriously. I’ve been on the fence about crypto for years, but this? This is why I’m not putting anything I can’t afford to lose on an exchange. I moved 90% of my holdings to cold storage last month. It’s a pain to access, but I sleep better.

If you’re new to this-don’t get overwhelmed. Start small. Learn what cold storage means. Don’t trust anything that doesn’t show you a live on-chain audit. And if a platform says ‘we’re compliant’ but won’t link to the actual report? Run.

You don’t need to be a genius. You just need to be careful.

Tom Joyner

December 24, 2025 AT 19:25Of course the ECB doesn’t approve Bitcoin ETFs. It’s not about risk. It’s about prestige. The euro is a reserve currency because it’s boring. Bitcoin is disruptive. And disruption is the enemy of central banks. This isn’t regulation-it’s cultural preservation.

Meanwhile, Americans are laughing all the way to the bank with $125B in ETFs. Europe? Still arguing over whether crypto is a commodity or a security. Pathetic.

Patricia Amarante

December 25, 2025 AT 15:12My cousin works at a regulated EU exchange. She says the compliance team is just a front. The real decision-makers don’t even read the reports. They just want to check the box so they don’t get fined. It’s all performative.

Don’t believe the ‘MiFID II approved’ label. Ask for the last 3 proof-of-reserves. If they can’t give you the Merkle root or the timestamped hash? Walk away.

Bradley Cassidy

December 27, 2025 AT 01:18bro i just checked my exchange and they say they have 90% cold storage… but i saw their wallet on etherscan and 30% of it moved in the last 48 hrs?? like… are we all just playing pretend here? 😅

also why do they charge 15€ to withdraw 0.1 BTC? that’s insane. i’m moving to kraken. peace.

Dionne Wilkinson

December 28, 2025 AT 07:35It’s strange, isn’t it? We’re told crypto is about freedom, decentralization, taking power from banks… but then we’re stuck in a system where the biggest bank in Europe is the one deciding if we can even trade. Maybe the real revolution isn’t Bitcoin. Maybe it’s realizing we’ve just swapped one gatekeeper for another.

SeTSUnA Kevin

December 29, 2025 AT 20:05ECB’s ‘review’ is a public relations exercise. The real data is classified. The 87% statistic? Likely inflated. The 48-minute delays? Correlated with exchange liquidity crunches, not systemic failure. The narrative is manufactured to justify the digital euro.

Don’t be fooled by fearmongering dressed as analysis.

Timothy Slazyk

December 30, 2025 AT 15:25You’re all missing the point. The ECB isn’t trying to stop crypto. It’s trying to kill it slowly-by making compliance so expensive and complex that only the giants can survive. Then they buy them. Or force them to become subsidiaries of state-backed entities.

Look at what happened to Germany’s BaFin. They blocked single-asset ETFs because ‘diversification is safer.’ But they approved a multi-asset crypto ETF that’s 90% Bitcoin. That’s not safety. That’s stealth adoption.

The ECB doesn’t want you to trade. They want you to invest through them. And when you do? You’ll pay fees. You’ll lose control. And you’ll think you’re protected.

This isn’t regulation. It’s colonization.

And if you think moving to Kraken fixes it? You’re wrong. Kraken is still subject to MiCA. They still have to freeze accounts. They still have to report your transactions. The system is designed to capture, not liberate.

So yes-use a hardware wallet. But don’t think you’ve won. You’ve just moved to a different cell.

Sue Bumgarner

January 1, 2026 AT 02:00Europe is weak. The U.S. leads. The UK leads. Germany? Still stuck in the 90s. The ECB is a relic. They think they’re protecting citizens, but they’re just protecting their own power. Crypto is the future. Europe is trying to bury it with bureaucracy. Pathetic.

Florence Maail

January 1, 2026 AT 12:39They’re lying. The ECB knows about the backdoor access all these exchanges have to the European banking system. They’re letting it happen because they’re getting a cut. That’s why they won’t shut them down. That’s why they’re dragging their feet. This isn’t about safety. It’s about money laundering with a fancy report.

And the digital euro? It’s a spy tool. They’ll track your every move. You’ll pay taxes before you even buy coffee. 😡

Chevy Guy

January 3, 2026 AT 07:51so the ECB says exchanges are unsafe… but they still let banks hold crypto as assets? huh. so banks are safe but exchanges are not? why? because banks are bigger? or because they’re the ones writing the rules? 🤔

Amy Copeland

January 3, 2026 AT 21:11How quaint. You think a few cold wallets and proof-of-reserves will save you? The real danger is that you’re still trusting *any* centralized entity. The ECB, the exchanges, the auditors-they’re all part of the same machine. Your hardware wallet? Just a placebo. The system owns you whether you know it or not.

And you call this ‘investing’? It’s feudalism with blockchain.

Sean Kerr

January 4, 2026 AT 12:45okay i just moved my coins to my ledger and i feel like a superhero 😎🙌

also-why do exchanges even exist if they’re this sketchy? just sayin’… maybe we don’t need them?

ps: if you’re still on an exchange, please stop. you’re literally giving your keys to strangers. 😭

Rebecca Kotnik

January 5, 2026 AT 19:20The structural vulnerabilities exposed in this analysis are not anomalies-they are systemic outcomes of a regulatory framework that prioritizes institutional stability over individual sovereignty. The ECB’s mandate is not to foster innovation but to mitigate systemic risk to the financial architecture of the Eurozone. This necessarily creates tension with decentralized financial models.

Moreover, the disparity in national regulatory approaches undermines the principle of mutual recognition under EU law, creating regulatory arbitrage opportunities that further erode investor confidence. The absence of a unified supervisory authority for crypto-assets is not an oversight-it is a deliberate structural compromise.

While individual prudence-such as cold storage and verification of proof-of-reserves-is essential, it cannot substitute for institutional accountability. The burden of security should not rest solely on retail participants when the architecture of the system is inherently unstable.

Until Europe develops a coherent, enforceable, and transparent regulatory regime that aligns with the technological realities of crypto-assets, the current state of affairs will persist: a façade of compliance masking profound vulnerability.

Sally Valdez

January 5, 2026 AT 22:24Who even cares about the ECB? They’re just a bunch of bureaucrats who think they know better than millions of people trading crypto. The U.S. is winning. The UK is winning. Why are we still listening to them? This isn’t about safety-it’s about control. And control is just another word for fear.

Also, the digital euro? That’s just a crypto they can shut off anytime. I’ll take Bitcoin any day.

Kayla Murphy

January 6, 2026 AT 00:18You got this. Seriously. Even if the system is broken, you’re still in control of your own coins. Move them. Learn. Stay calm. The market will keep moving-and so will you.

Small steps. Big wins.

Emma Sherwood

January 7, 2026 AT 18:29As someone who grew up in a country where banking was unreliable, I see this differently. The ECB isn’t perfect-but it’s trying. In many places, there’s no regulator at all. No audits. No oversight. No protection.

Yes, the system is flawed. But it’s better than nothing. Let’s push for reform-not retreat.

Use cold wallets. Demand transparency. Support the good exchanges. Don’t give up on Europe. Help fix it.

Jesse Messiah

January 8, 2026 AT 02:44cool post. i’ve been using bitpanda for a while-just checked their site and they do have the MiFID II stamp. also published their proof-of-reserves last week. so i’m good. but yeah… i keep 80% in my ledger. better safe than sorry 😊

Terrance Alan

January 9, 2026 AT 02:57Everyone’s acting like this is news. It’s not. The ECB has been saying this for years. You just didn’t listen. You thought you could get rich quick. Now you’re mad because the system didn’t protect you from your own greed.

Stop blaming the regulators. Blame yourself for trusting a system built on trust.

Madhavi Shyam

January 10, 2026 AT 07:58They just released the new MiCA compliance dashboard. 12 exchanges now show live on-chain proof. One of them is Bitstamp. Check their wallet. It’s verified. No more guessing.

Kelsey Stephens

January 11, 2026 AT 03:44That’s huge. I just checked. Bitstamp’s Merkle root is updated every 4 hours. I’m moving the rest of my BTC there. Thank you for the update.

Timothy Slazyk

January 11, 2026 AT 17:39Live dashboards are theater. The keys are still controlled by the same custodians. The same people who froze accounts in 2022. The same people who delayed withdrawals during the Terra crash. Transparency doesn’t equal safety. It just makes you feel safer.