Key Takeaways

- Skrumble Network (SKM) is an Ethereum‑based token that aims to power a fully decentralized messaging ecosystem.

- The token trades around $0.000038 USD with very low daily volume and a bearish technical outlook.

- SKM’s value comes from its utility for secure chat, file sharing, voice/video calls, and built‑in crypto transfers.

- Adoption is limited - only a few thousand addresses hold the coin and active on‑chain activity is near zero.

- Investors should treat SKM as a high‑risk, speculative asset until the network shows real usage.

When you hear the name Skrumble Network, you might picture a fancy new chat app. In reality, it’s a crypto token built on Ethereum a global, open‑source blockchain that runs smart contracts and supports ERC‑20 tokens. The token’s ticker is SKM the native cryptocurrency that fuels the Skrumble Network ecosystem. Below, we break down what the project promises, how it actually works, and why you should be cautious before buying.

What Is Skrumble Network?

Skrumble Network a decentralized communication platform that uses the SKM token to unlock secure messaging, file sharing, and voice/video calls aims to replace centralized messengers like WhatsApp or Telegram. Instead of storing chats on a single server, Skrumble spreads data across a global network of nodes. That design is meant to stop censorship, avoid single‑point‑of‑failure attacks, and give users full control over their conversations.

The platform is still in development. The roadmap mentions a mobile app that combines traditional text chat, peer‑to‑peer audio/video, and the ability to send crypto directly within a conversation. If the team delivers, the whole stack would run on smart contracts, meaning every message‑related action (sending, receiving, deleting) is verified on the blockchain.

How Does the SKM Token Work?

The SKM token follows the ERC‑20 standard, so it’s compatible with any Ethereum wallet - MetaMask, Trust Wallet, or Ledger. The token has a circulating supply of about 1.5billion units, valued at roughly $57USD in total market cap at current prices. Token holders can use SKM to pay for network services, such as unlocking premium chat features or buying extra storage.

Because the token lives on Ethereum, developers can write smart contracts self‑executing code that runs when predefined conditions are met, enforcing token transfers and service access that automate payments without a middleman. In theory, this reduces transaction fees and speeds up settlement compared to traditional payment processors.

In practice, most SKM holders are just speculating on price. The blockchain explorer shows 33,790 addresses own the token, but active on‑chain transactions are almost nonexistent. That suggests the network is still waiting for a real‑world use case to go live.

Market Performance (Price, Volume, Supply)

As of the latest snapshot (Oct22025), SKM trades at $0.000038USD, a negligible 0.01% drop over the past 24hours. Over the past week the token fell 0.60%, while the broader crypto market rose 0.40%.

Daily trading volume averages $79k, down 1.80% from the previous day. Most of that activity occurs on the Gate exchange a centralized crypto exchange that lists the SKM/USDT pair and handles the majority of SKM liquidity. Outside of Gate, liquidity is thin, which makes large orders cause noticeable price swings.

Historically, SKM hit an all‑time high of BTC0.00001291 and a low of BTC0.00000000092397. The current price represents a 100% decline from its peak, but it’s still over 100% above the absolute low. The average balance per address is only $2.35, and the typical transaction value is effectively zero - a clear sign that the token isn’t being used for everyday communication services yet.

Technical Outlook

Technical analysis from TradingView a popular charting platform that provides price indicators and trading signals for cryptocurrencies paints a mostly bearish picture. The platform shows a neutral signal for immediate trading, but both the 1‑week and 1‑month timeframes recommend a sell. Moving averages are trending down, and the Relative Strength Index (RSI) sits near the lower‑end of its range, indicating oversold conditions but also weak momentum.

Because SKM relies on Ethereum’s gas fees, transaction costs can spike during network congestion, which could further deter users from sending frequent messages or small payments.

Competitive Landscape

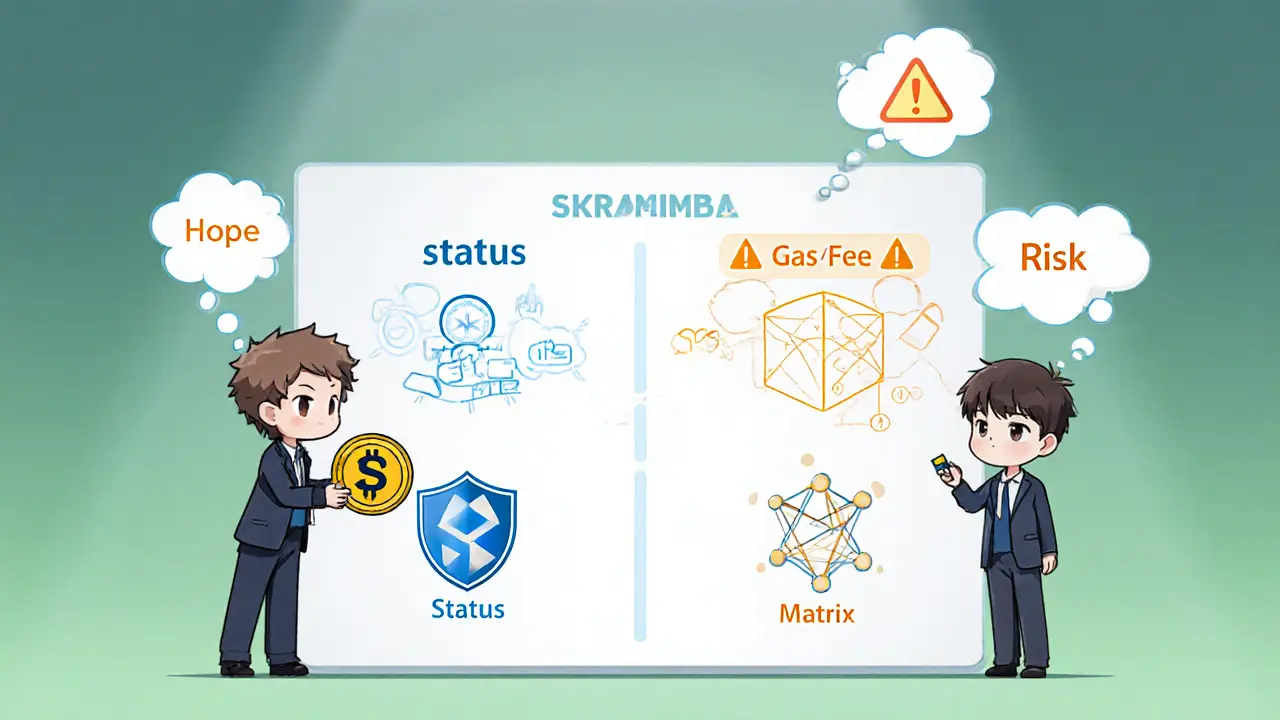

Several other projects claim to solve the same problem - secure, decentralized messaging. Below is a quick feature comparison.

| Feature | Skrumble Network | Status | Matrix | Whisper (Ethereum) |

|---|---|---|---|---|

| Blockchain base | Ethereum (ERC‑20) | Ethereum | Custom federated servers | Ethereum |

| Voice/Video calls | Planned (peer‑to‑peer) | Yes (via Status App) | No native | No |

| On‑chain messaging | Yes (smart contract mediated) | Yes (encrypted off‑chain, on‑chain settlement) | No (off‑chain only) | Yes (low‑level) |

| Token utility | SKM pays for services | SNT token for staking & services | None (room‑based) | None |

| Active users (approx.) | ~0 (on‑chain) | ~30k (Status) | Millions (Matrix) | Very low |

While Skrumble offers a broader suite (messaging + calls + crypto), its actual user base is tiny compared with Status or Matrix. The key to success will be delivering a seamless, cost‑effective experience that convinces people to switch from free, centralized apps.

How to Buy and Store SKM

1. Choose a reputable exchange. The most liquid market is on Gate, but you can also find SKM on smaller DEXs via the SKM/ETH pair.

2. Complete KYC. Centralized platforms require identity verification before you can move money.

3. Transfer to an Ethereum‑compatible wallet. After purchase, send the tokens to MetaMask, Trust Wallet, or a hardware device like Ledger. Because SKM is an ERC‑20 token, any wallet that supports Ethereum will work.

4. Verify the contract address. Always double‑check the SKM contract (0x… placeholder) on Etherscan to avoid scams.

5. Monitor market data. Prices swing wildly, so set alerts if you plan to trade.

Risks and Considerations

- Low adoption. With virtually no active addresses, the network isn’t proving its core value yet.

- Bearish technical signs. TradingView’s sell recommendations across multiple timeframes suggest further downside risk.

- Ethereum gas fees. Even a tiny message could cost $0.10-$0.30 during peak congestion.

- Regulatory uncertainty. Messaging platforms can attract scrutiny, especially if they’re used for illicit communication.

- Project execution risk. The roadmap outlines ambitious features (firewall‑resistant calls, integrated crypto) that require heavy development resources.

If you decide to allocate any funds to SKM, treat it as a high‑risk experimental bet. Diversify your crypto portfolio and never invest more than you can afford to lose.

Frequently Asked Questions

What is the main purpose of the Skrumble Network?

Skrumble Network aims to create a fully decentralized messaging ecosystem where chats, files, and calls are stored on a blockchain rather than on a central server, giving users ownership of their data.

How can I buy SKM tokens?

The most liquid venue is the Gate exchange (SKM/USDT pair). After creating an account and completing KYC, you can purchase SKM and transfer it to any Ethereum‑compatible wallet.

Is SKM currently usable for messaging?

Not yet. The network’s core messaging features are still in beta, and on‑chain activity shows almost no real‑world usage. The token’s primary function today is speculation.

What are the biggest risks of investing in SKM?

Low adoption, bearish technical indicators, high Ethereum gas fees, and the uncertainty of delivering the promised decentralized communication platform all create significant downside risk.

How does SKM compare to other decentralized chat apps?

Unlike Status or Matrix, Skrumble plans to embed voice/video calls and token‑based payments directly on‑chain. However, its user base and on‑chain activity are far lower, meaning the ecosystem is still in its infancy.

Bottom line: Skrumble Network is an ambitious concept with a native token that could become valuable if the team delivers a working, user‑friendly decentralized messenger. As of October2025, the token’s price is tiny, trading volume is thin, and technical analysis leans heavily toward a sell. If you’re curious about the tech, feel free to explore the open‑source code on GitHub, but treat any investment as speculative at best.

Emma Szabo

January 5, 2025 AT 06:20Reading through the SKM deep‑dive feels like taking a tour through a futuristic bazaar that’s still under construction. The whitepaper promises a utopia where every whisper, photo, and video sails on Ethereum’s immutable ledger, immune to the prying eyes of any corporate overlord. Yet, the reality on‑chain looks more like a ghost town, with just a few thousand wallets and a trading volume that barely registers a blip in the market’s roar. The token’s price is perched at a fraction of a cent, and the daily volume hovers around a modest $79k, which could evaporate with a single large order. Technical analysis paints a bearish tableau-moving averages sloping down, RSI flirting with oversold territory, and the sell signals flashing across weekly and monthly charts. Gas fees on Ethereum add another layer of friction; sending a tiny message could cost more than the message itself during peak congestion. While the roadmap teases an all‑in‑one app with chat, voice, video, and crypto transfers, the development milestones remain shy of any real‑world beta release. Competitors like Status and Matrix already boast active communities, making SKM’s user acquisition challenge a Herculean task. For an investor, this translates into a high‑risk speculative play, where the reward hinges entirely on the team’s ability to deliver a seamless, cost‑effective product. On the bright side, the open‑source ethos means anyone can audit the code and perhaps contribute to its evolution. Diversification remains the prudent path-pair SKM exposure with more established assets if you decide to dip a toe in this experimental pond. In short, SKM is a bold concept shackled by thin adoption, bearish technicals, and the relentless drag of Ethereum gas fees. Treat it as a high‑stakes gamble, and never allocate funds you can’t afford to lose. The future of decentralized messaging is exciting, but at present SKM is more a promise than a proven platform.

Fiona Lam

January 5, 2025 AT 07:36Honestly, this SKM hype train is nothing but hot air. The so‑called "decentralized messaging" sounds great on paper, but with near‑zero on‑chain activity it's a joke. If the team can't even get a few dozen users, why should anyone waste gas on it? The bearish signals are screaming sell, so pull the plug now before you lose even more.

OLAOLUWAPO SANDA

January 5, 2025 AT 08:53People keep praising SKM, but the facts are clear: adoption is practically zero and the token price is collapsing. It's a classic case of hype over substance, and anyone buying now is just chasing a dying dream.

Alex Yepes

January 5, 2025 AT 10:10The technical outlook for SKM appears bearish, with declining moving averages and a low RSI suggesting weak momentum. Moreover, Ethereum gas fees may further discourage users from adopting the platform. Prospective investors should consider these risk factors carefully before allocating capital.

Sumedha Nag

January 5, 2025 AT 11:26Look, I get the excitement around a decentralized chat app, but SKM is barely moving. The roadmap sounds cool, yet there's no real usage yet. I'd keep my money in something with actual activity.

Holly Harrar

January 5, 2025 AT 12:43if u wanna try skm, first double check the contract address lol. also dont forget 2fa on your exchange. safety first, always.

Vijay Kumar

January 5, 2025 AT 14:00For anyone considering SKM, remember that the token is ERC‑20, so any Ethereum wallet works. However, the actual messaging service isn’t live yet, so you’re mostly buying speculation. Keep an eye on the roadmap updates, and only allocate a small portion of your portfolio.

Edgardo Rodriguez

January 5, 2025 AT 15:16When we examine the data, we see a stark contrast: on‑chain activity is near‑nonexistent, yet the marketing narrative paints a bustling ecosystem; consequently, the discordance raises substantive doubts; furthermore, the reliance on Ethereum's gas structure introduces variable transaction costs that could deter micro‑interactions; in addition, the technical indicators-moving averages descending, RSI approaching oversold zones-compound the bearish outlook; thus, an investor must weigh these multifaceted risks before committing capital.

mudassir khan

January 5, 2025 AT 16:33From a formal perspective, the SKM token lacks substantial liquidity; the volume is minimal, which may result in significant slippage for sizable orders; additionally, the projected utility is speculative at best, given the current inactivity on the blockchain; consequently, a prudent approach would involve a thorough risk assessment prior to any purchase.

Bianca Giagante

January 5, 2025 AT 17:50While the analysis points to bearish signals, it's essential to maintain a balanced view; market sentiment can shift, and new partnerships could spark adoption; thus, keeping an open mind while monitoring developments is advisable.

Andrew Else

January 5, 2025 AT 19:06Sure, sure, another "revolutionary" token.

Susan Brindle Kerr

January 5, 2025 AT 20:23Honestly, the whole SKM saga feels like a tragic opera-grand promises, empty stages, and a chorus of hollow echoes. One might say it's a cautionary tale for dreamers.

Jared Carline

January 5, 2025 AT 21:40From a highly formal standpoint, the current market metrics suggest limited viability; the token's liquidity constraints coupled with subpar adoption rates warrant a cautious posture.

raghavan veera

January 5, 2025 AT 22:56Yo, the SKM hype is real but the actual usage? Practically zero. Might be worth watching if they drop a live app soon.

Danielle Thompson

January 6, 2025 AT 00:13Quick tip: always verify the contract address before sending SKM! ⚡️

Eric Levesque

January 6, 2025 AT 01:30SKM is just another meme token with no real purpose, so don’t waste your money.

alex demaisip

January 6, 2025 AT 02:46In terms of tokenomics, SKM exhibits a diluted supply model coupled with suboptimal market depth, thereby impeding efficient price discovery mechanisms. The on‑chain adoption metrics are insufficient to substantiate the projected utility claims, rendering the asset high‑risk from a portfolio diversification perspective.

Elmer Detres

January 6, 2025 AT 04:03While I respect the concerns raised about gas fees, the potential for on‑chain messaging could still carve out a niche if the team streamlines the user experience and lowers transaction costs.

Tony Young

January 6, 2025 AT 05:20Exactly, if they manage to integrate layer‑2 solutions or rollups, the fee barrier could be mitigated, making SKM more accessible for everyday chats.

Fiona Padrutt

January 6, 2025 AT 06:36Love the reminder! Always double‑check the address before moving SKM 🚀

Briana Holtsnider

January 6, 2025 AT 07:53Agreed, careful verification is key; a single typo can lead to a lost investment.

Corrie Moxon

January 6, 2025 AT 09:10