DueDEX Review: What It Is, How It Works, and If It’s Worth Your Crypto

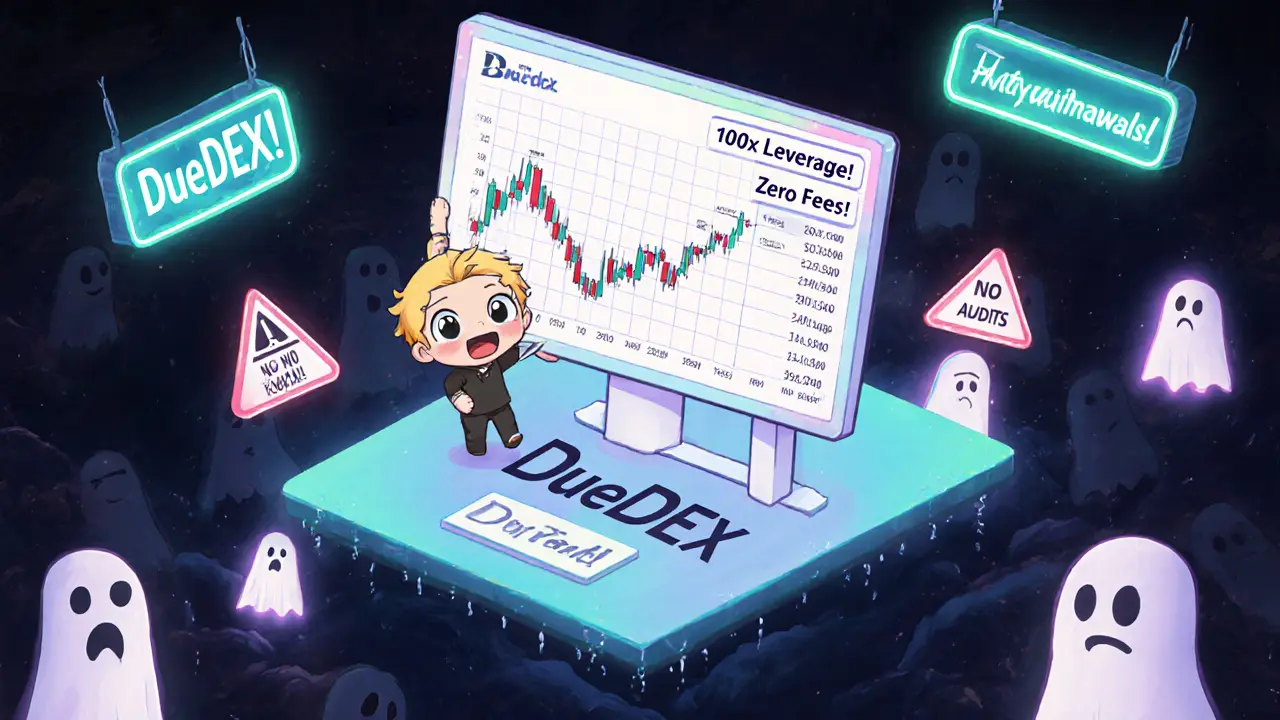

When you hear DueDEX, a decentralized exchange built for high-frequency trading on blockchain networks, you might think it’s another fast, cheap way to trade crypto. But here’s the truth: DueDEX isn’t a household name like Uniswap or PancakeSwap. It’s a niche platform, often used by traders chasing small-cap tokens with thin liquidity. It’s not for beginners. It’s not for casual holders. It’s for people who know exactly what they’re doing—and still take big risks.

What makes DueDEX different? It runs on its own chain, optimized for speed and low fees. That sounds great, right? But speed means nothing if no one’s trading. Many users report slippage over 10% on small orders, and some tokens listed there have zero volume for days. It’s not a bug—it’s the design. DueDEX thrives on volatility, not stability. That’s why you’ll find posts here about tokens like ArbiDex Token (ARX), a low-liquidity crypto token on Arbitrum with almost no trading volume, or Wagmi (zkSync Era), a DeFi protocol with minimal trading volume and no transparency. These aren’t random examples. They’re the kind of assets that live on platforms like DueDEX. If you’re looking for a safe, regulated exchange with customer support, this isn’t it. But if you’re hunting for the next micro-cap pump, you’ll find plenty of candidates here.

There’s no official team behind DueDEX you can contact. No roadmap. No whitepaper updates. Just a live DEX interface and a list of tokens that change daily. That’s why so many users get burned. They see a token with a 500% spike, jump in, and can’t get out because the liquidity dries up. The same pattern shows up in reviews of Nexus Trade, a simple, low-fee crypto exchange for beginners who want to buy and hold without complex tools, or HTX (Huobi) Indonesia, a crypto exchange with local fiat options and leverage for Indonesian users. Those platforms have structure. DueDEX doesn’t. It’s a wild west marketplace—and that’s exactly why some traders love it. But if you’re not ready for the chaos, you’ll lose money fast.

Below, you’ll find real reviews and deep dives on platforms like DueDEX, the tokens traded there, and the risks no one warns you about. These aren’t hype pieces. They’re facts pulled from trading data, on-chain activity, and user reports. If you’re thinking about using DueDEX, read these first. You’ll know exactly what you’re walking into.