High Leverage Crypto: Risks, Rewards, and What You Need to Know

When you trade high leverage crypto, a trading strategy that lets you control a large position with a small amount of your own capital. Also known as leveraged trading, it’s used by traders who want to multiply returns—but it’s not for beginners. Most crypto exchanges let you borrow funds to trade, sometimes up to 100x your deposit. That means a $100 bet could control $10,000 worth of Bitcoin. Sounds powerful? It is. But if the market moves just 1% against you, you’re wiped out.

This isn’t just about Bitcoin or Ethereum. You’ll find high leverage crypto options on low-liquidity tokens too, like RP1, ARX, or URANUS—tokens with tiny trading volumes and no real backing. These are the ones that get crushed fast when leverage turns against you. Exchanges like HTX and Nexus Trade offer these tools, but they don’t tell you how often retail traders lose everything on them. A 2023 study by Chainalysis showed over 70% of leveraged traders on altcoins lost money within 30 days. The ones who win? They’re not gambling—they’re watching volume, funding rates, and liquidation levels like hawkers.

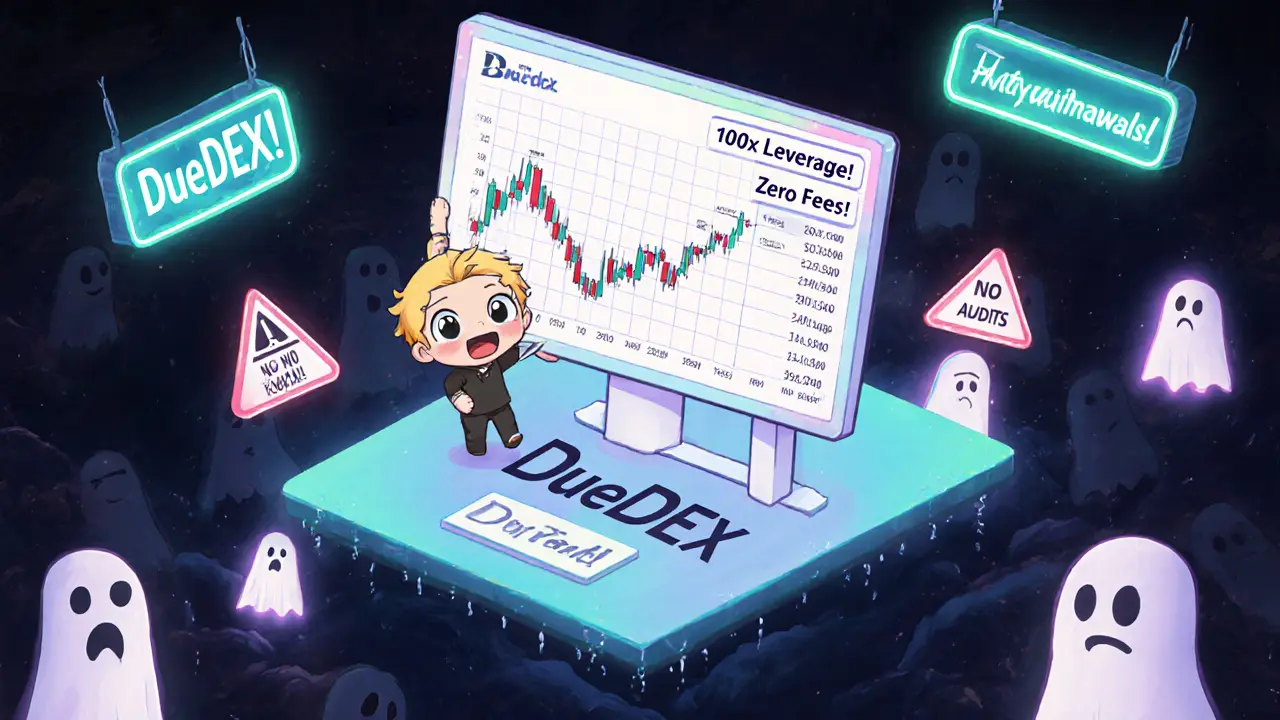

High leverage isn’t a strategy. It’s a tool. And like a chainsaw, it’s useless without control. You need to understand margin trading, the process of borrowing funds to open a position larger than your account balance, and how crypto exchanges platforms that allow buying, selling, and borrowing digital assets with leverage calculate liquidation prices. Some hide the math. Others show you exactly when your position will be auto-sold. The difference? Thousands of dollars.

There’s no magic formula to win with leverage. But there are patterns. You’ll see them in the posts below—real examples of tokens that blew up under leverage, exchanges that quietly raised fees when volatility spiked, and traders who survived by cutting losses early. You’ll also find warnings about fake airdrops tied to leveraged pools and how some tokens, like Darkpino or AiShiba, are built to be crushed by short sellers using leverage. This isn’t theory. It’s what’s happening right now.