Imagine a blockchain that uses less electricity than a single household. That’s not science fiction - it’s Proof of Stake today. Before September 2022, Ethereum burned through as much power as a small country. After switching to Proof of Stake, its energy use dropped by 99.95%. That’s not a small improvement. It’s a revolution.

How Proof of Stake Works - No Mining Required

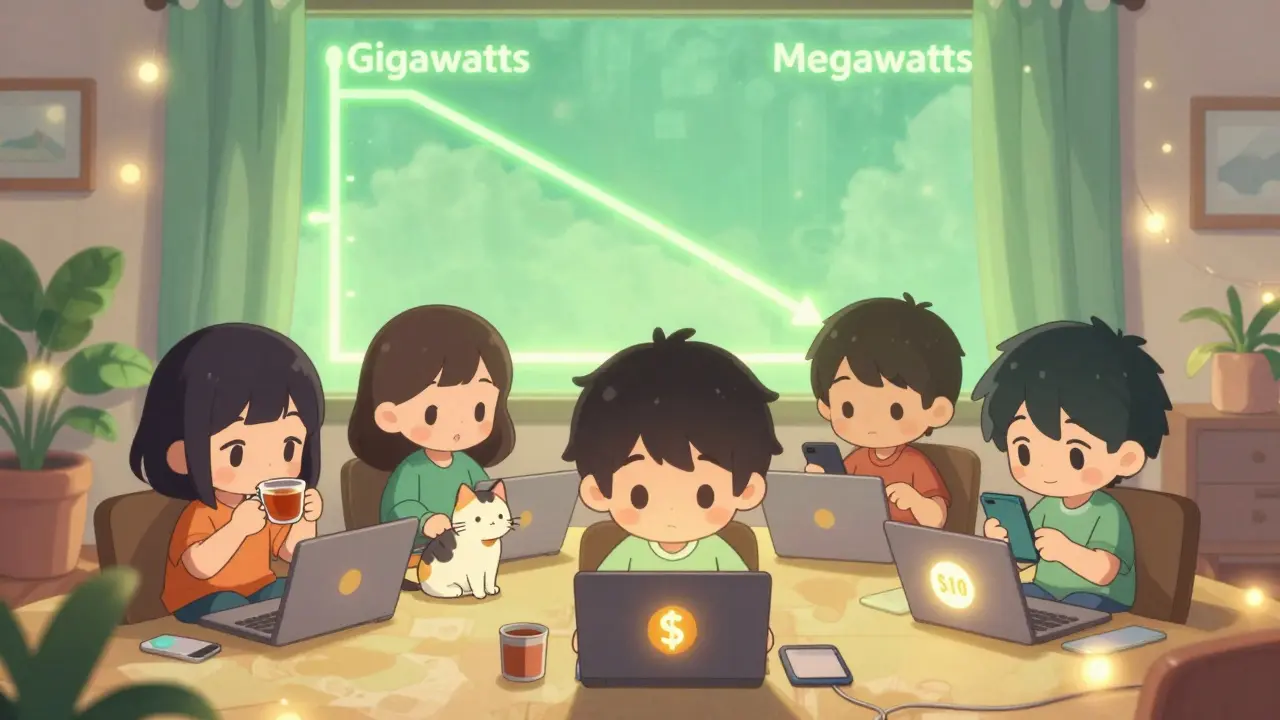

Proof of Work, the original blockchain consensus method, is like a global competition where miners race to solve impossible math puzzles. The winner gets rewarded with new coins. But every guess, every calculation, burns electricity. Bitcoin’s network alone uses more power annually than Norway. Proof of Stake throws that system out. Instead of computers competing with brute force, validators are chosen based on how much cryptocurrency they’re willing to lock up - or “stake” - as collateral. If you stake 32 ETH on Ethereum, you become eligible to validate transactions. If you act honestly, you earn rewards. If you cheat, you lose your stake. No mining rigs. No noise. No massive power bills. This shift isn’t theoretical. Ethereum, the second-largest blockchain by market value, made the switch in September 2022. The result? Energy use fell from 5.13 gigawatts to just 2.62 megawatts. That’s a 1,957x reduction. You could power every Ethereum validator on the planet with the electricity used by one large data center.The Numbers Don’t Lie: PoS vs PoW Energy Use

Here’s what the data shows when you compare real-world numbers:- Ethereum (PoW): 5.13 gigawatts of continuous power - enough to run 1.7 million U.S. homes.

- Ethereum (PoS): 2.62 megawatts - less than a single Walmart store.

- Bitcoin (PoW): 112.06 terawatt-hours per year - more than Norway’s entire national consumption.

- Combined PoS networks (Ethereum, Solana, Cardano, Polkadot, Tezos): ~2,500 megawatt-hours per year - equivalent to 200 average U.S. households.

- Energy per transaction: Bitcoin uses 830 kWh per transaction. Ethereum PoS uses 0.036 kWh - that’s 23,000 times less.

Why This Matters Beyond the Environment

It’s easy to think of energy use as just an environmental issue. But it’s also an economic and regulatory one. Institutional investors - hedge funds, pension funds, banks - were hesitant to touch crypto because of its carbon footprint. Fidelity’s 2023 ESG report said Ethereum’s switch to PoS was a “critical factor” in their clients accepting it as an investment. Grayscale, BlackRock, and others followed. Why? Because ESG compliance is no longer optional. Companies that hold crypto now prioritize PoS assets. According to Bitwave.io’s 2024 report, 73% of corporate treasuries doing crypto investments now choose PoS chains - up from 28% in 2021. Regulators noticed too. The European Union’s MiCA rules treat PoS validators differently than PoW miners, giving them clearer legal standing. In the U.S., Senators Lummis and Gillibrand introduced the Pro-Proof-of-Stake Act in 2023 to protect and clarify the legal status of staking. Countries are starting to see PoS as the only blockchain model that can scale without harming climate goals.

Lower Barriers, Broader Access

Proof of Work required expensive hardware. A single Bitcoin ASIC miner costs $5,000 to $20,000 and guzzles 5,000+ watts. You needed cheap electricity, cooling systems, and technical know-how just to break even. Proof of Stake changes that. You don’t need special gear. A regular laptop with 8 GB of RAM, a 2-core processor, and 64 GB of storage is enough to run an Ethereum validator. Setup takes 2-4 hours for someone with basic tech skills. And if you don’t want to run your own node? You can stake as little as $10 on Coinbase, Kraken, or Lido. No hardware. No electricity bills. Just click and earn. In Q1 2024 alone, Coinbase added 1.2 million new stakers. Most of them had never run a server. They didn’t need to. PoS made participation accessible - not just for tech elites, but for everyday people.What About Centralization Risks?

Critics say PoS favors the rich. If you need 32 ETH (around $100,000) to become a validator, won’t only wealthy players control the network? It’s a fair concern. But the data doesn’t support it yet. Ethereum’s validator distribution is still decentralized. As of mid-2024, the top 10 staking providers control about 32% of all staked ETH - meaning 68% is spread across thousands of individual validators. That’s far more distributed than Bitcoin mining, where just three mining pools control over 70% of hash power. Plus, liquid staking derivatives (LSDs) like stETH and rsETH let you stake any amount and still earn rewards while keeping your assets liquid. This has opened the door for small investors to participate without locking up $100K. Over $32 billion is now locked in LSD protocols.

What’s Next for PoS?

PoS isn’t static. It’s evolving. Ethereum’s Dencun upgrade in February 2024 cut transaction energy use by another 10% through proto-danksharding. The upcoming Verkle Trees upgrade in 2025 will make data storage even more efficient. Other chains are building on PoS too. Solana uses Proof-of-History to speed up consensus. Cardano’s Ouroboros protocol is mathematically proven to be secure with minimal energy. Polkadot and Tezos are already running on PoS with near-zero emissions. Gartner predicts that by 2027, 95% of enterprise blockchain projects will use PoS or a variant. Why? Because it’s the only model that can scale sustainably. The Cambridge Centre for Alternative Finance summed it up: “PoS represents the only consensus mechanism with a viable path to net-zero blockchain operations at scale.”Final Thought: It’s Not About Being Green - It’s About Being Smart

Proof of Stake isn’t just “greener.” It’s smarter. It’s cheaper. It’s more accessible. It’s scalable. And it’s already working at massive scale. Bitcoin’s PoW model was groundbreaking in 2009. But the world has changed. Climate goals, regulatory pressure, and investor demands have made energy waste a liability - not a feature. Proof of Stake didn’t just improve blockchain. It redefined what blockchain could be. No more trade-offs between security and sustainability. No more choosing between decentralization and efficiency. PoS gives you all three. The energy crisis in crypto is over. Proof of Stake won.Is Proof of Stake really 99.95% more energy efficient than Proof of Work?

Yes. Ethereum’s transition from Proof of Work to Proof of Stake in September 2022 reduced its energy consumption from 5.13 gigawatts to 2.62 megawatts - a 99.95% drop. This figure was confirmed by the Ethereum Foundation, EY, and FTSE Russell. The same ratio applies to Bitcoin vs. Ethereum PoS: Bitcoin uses roughly 23,000 times more energy per transaction.

Can I stake Ethereum with less than 32 ETH?

Yes. You don’t need to stake 32 ETH yourself. Platforms like Coinbase, Kraken, and Lido allow you to stake any amount - even $10. Your funds are pooled with others, and you receive proportional rewards. This is called liquid staking, and it’s how most retail users participate in Ethereum’s Proof of Stake network.

Does Proof of Stake make blockchains less secure?

No. Proof of Stake is designed to be just as secure as Proof of Work - but through economic incentives instead of computational power. If a validator tries to cheat or validate fake transactions, they lose their staked ETH. This “slashing” mechanism makes attacks financially irrational. Ethereum’s PoS network has operated securely for over two years with no major breaches.

Which blockchains use Proof of Stake?

Major blockchains using Proof of Stake include Ethereum, Cardano, Solana, Polkadot, Tezos, and Avalanche. Most new blockchains launched since 2022 use PoS or a variant. Bitcoin and Litecoin are the only major networks still using Proof of Work.

Is Proof of Stake better for the environment than Bitcoin?

Yes - by an enormous margin. Bitcoin’s annual carbon footprint is 62.51 million tonnes of CO2e. The entire PoS ecosystem (Ethereum, Solana, Cardano, Polkadot, Tezos) emits less than 1,000 tonnes annually. That’s over 60,000 times less. PoS networks collectively use less electricity than 200 U.S. households. Bitcoin uses more than an entire country.

Will Proof of Work disappear completely?

It’s unlikely to vanish overnight, but its role is shrinking fast. Bitcoin mining will continue, but it’s increasingly isolated. New projects avoid PoW because of regulatory and ESG risks. Institutional capital is flowing to PoS. Gartner predicts that by 2027, 95% of enterprise blockchains will use PoS. PoW is becoming a legacy system - like dial-up internet.

Freddy Wiryadi

January 28, 2026 AT 15:41christal Rodriguez

January 29, 2026 AT 20:26Brianne Hurley

January 31, 2026 AT 05:41Tressie Trezza

February 1, 2026 AT 22:39Joshua Clark

February 3, 2026 AT 00:44Rob Duber

February 3, 2026 AT 05:34