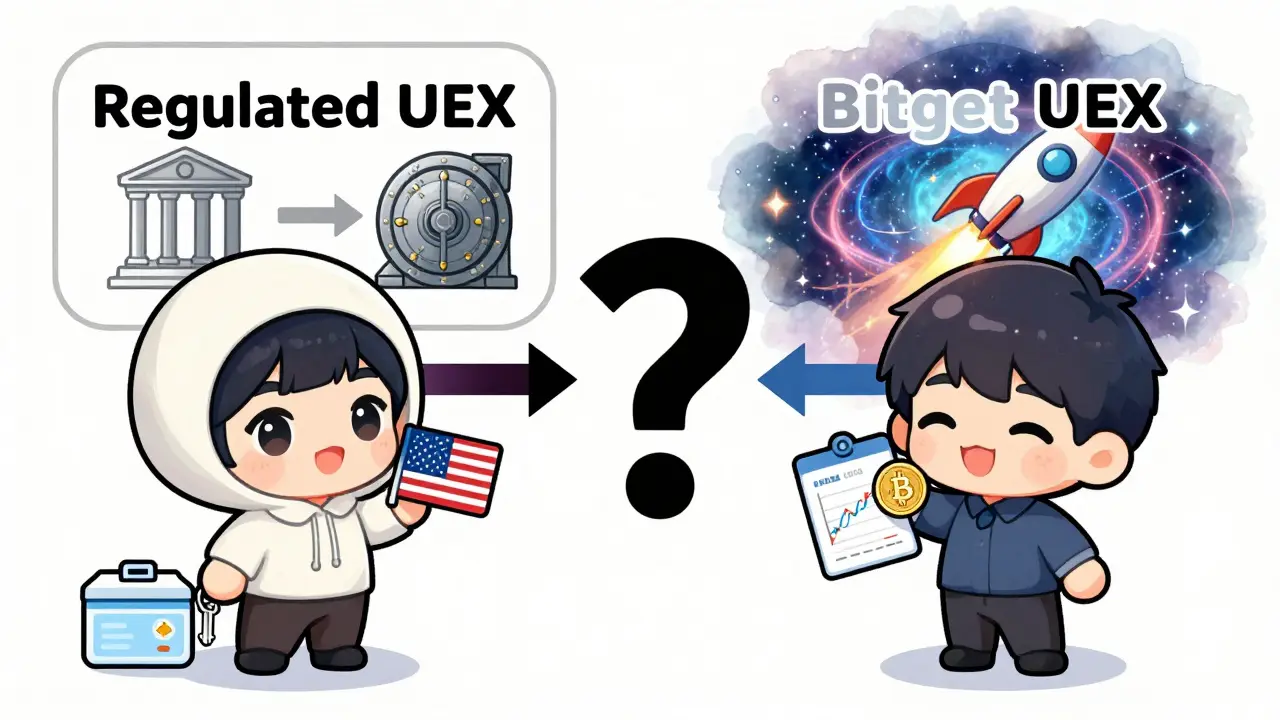

There are two very different platforms called UEX in the crypto world - and mixing them up could cost you. One is a U.S.-regulated exchange focused on compliance. The other is Bitget’s ambitious push to merge Wall Street with crypto. If you’re looking at UEX, you need to know which one you’re dealing with.

UEX Crypto Exchange: The Regulated U.S. Platform

This version of UEX operates under U.S. financial law. It’s registered as a Money Service Business (MSB) with FinCEN, meaning it follows strict anti-money laundering and know-your-customer rules. If you’ve used Coinbase or Kraken, this is the same kind of setup: no anonymity, no shady backdoors, and real legal accountability.

Before you can trade, you must complete full KYC. That means uploading a government-issued ID, a selfie, and sometimes proof of address. It’s not fast, but it’s not meant to be. This isn’t a platform for people who want to trade without a paper trail. It’s for those who want to know their funds are protected by law, not just code.

Security isn’t an afterthought here. The majority of user funds are kept in cold storage - offline wallets that require multiple digital keys to unlock. Think of it like a bank vault that needs three people to open it, each holding a different key. No single employee, hacker, or insider can move money alone.

All data transfers are encrypted end-to-end, and automated fraud detection tools watch for unusual activity. Regular third-party audits confirm the system holds up under pressure. TechBullion called it “exactly what we’d expect from a reputable exchange.” That’s not marketing fluff - it’s industry validation.

But there’s a trade-off. If you value privacy above all else, UEX isn’t for you. No-KYC exchanges exist, but they come with higher risk and zero legal recourse. UEX chooses safety over secrecy, and that’s a deliberate design.

Bitget’s Universal Exchange (UEX): When Crypto Meets Stocks

This is where things get confusing. Bitget, a major global exchange, launched its own “Universal Exchange” concept in 2025. It’s not a separate platform - it’s an expansion of Bitget itself. They’re calling it UEX to signal a new phase: crypto doesn’t have to replace traditional finance. It can join it.

What does that mean in practice? You can now trade tokenized versions of Apple, Nvidia, and Tesla stocks directly on Bitget. These aren’t crypto coins - they’re digital representations of real company shares, backed by actual assets through partners like xStocks and Ondo Finance. You’re not buying stock on Robinhood. You’re buying a crypto token that mirrors its value.

They’ve also added Stock Futures. That means you can bet on whether Apple’s price will go up or down over the next hour, day, or week - using crypto as collateral. No brokerage account needed. Just log in, pick your asset, and place your trade.

Bitget supports assets on Ethereum, BSC, Base, and Solana. That’s a wide range of networks, giving users flexibility in fees and speed. Their infrastructure includes a hybrid custody model - mixing hot and cold wallets - and a User Protection Fund worth over $700 million. That fund acts like insurance: if something goes wrong, this money is set aside to cover losses.

What sets Bitget apart is transparency. Every month, they publish a Proof of Reserves report using Merkle Tree verification. This lets you check if your balance is actually backed by real assets. In September 2025, their reserve ratio hit 186%. That means for every $1 users deposited, Bitget held $1.86 in reserves. That’s not just safe - it’s unusually strong.

They also have AI tools like GetAgent, which analyzes market trends and suggests trades based on your risk profile. It’s not a bot that trades for you automatically - it’s a smart assistant that gives you insights you wouldn’t get from a chart alone.

Side-by-Side Comparison: Which UEX Is Right for You?

| Feature | UEX Crypto Exchange | Bitget Universal Exchange (UEX) |

|---|---|---|

| Primary Focus | Regulated U.S. crypto trading | Integrating crypto with stocks and ETFs |

| KYC Required | Yes, mandatory | Yes, global standard |

| Asset Types | Bitcoin, Ethereum, altcoins | Crypto + tokenized stocks, ETFs, futures |

| Security Model | Cold storage + multi-sig + audits | Hybrid custody + $700M protection fund |

| Transparency | Third-party audits | Monthly Proof of Reserves (Merkle Tree) |

| AI Tools | No | Yes - GetAgent for insights |

| Best For | U.S. users wanting compliance and safety | Traders who want crypto + traditional assets in one place |

If you live in the U.S. and want a clean, legal way to trade Bitcoin and Ethereum, go with the standalone UEX Crypto Exchange. It’s simple, secure, and built for regulators - not speculators.

If you’re outside the U.S. or want to trade Apple stock using ETH as collateral, Bitget’s UEX is the only option. It’s more complex, but it opens doors most exchanges don’t even have.

Who Should Avoid These Platforms?

Neither UEX platform is right for everyone. If you’re looking for complete privacy - no ID, no trace, no questions asked - skip both. You’ll need a non-KYC exchange like Bisq or a peer-to-peer marketplace. But remember: those come with no safety net. No insurance. No legal protection. If something goes wrong, you’re on your own.

Also avoid both if you’re new to crypto and don’t understand derivatives or tokenized assets. Bitget’s UEX isn’t beginner-friendly. Trading stock futures with crypto isn’t the same as buying Bitcoin. You need to know what leverage is, how margin works, and how quickly things can go sideways.

And if you’re looking for low fees - neither platform is the cheapest. UEX isn’t built for volume traders. Bitget’s UEX offers more features, but fees are standard for advanced platforms. Don’t choose either just because they’re “low cost.” Choose them because they match your goals.

What’s Next for UEX?

The standalone UEX Crypto Exchange will likely keep growing slowly. More users will come as U.S. regulations tighten and unregulated exchanges get shut down. Compliance is becoming the new standard, not the exception.

Bitget’s Universal Exchange is the wild card. If they can keep their reserve ratios high, maintain regulatory compliance across multiple countries, and keep adding real assets (like bonds or commodities), they could redefine what a crypto exchange means. Right now, they’re betting that people want one app for everything - crypto, stocks, ETFs, and futures.

That’s ambitious. And risky. But if it works, it could be the future.

Frequently Asked Questions

Is UEX Crypto Exchange safe?

Yes, UEX Crypto Exchange is one of the safer platforms for U.S. users. It’s registered with FinCEN as an MSB, uses cold storage with multi-signature security, and undergoes regular third-party audits. It’s not perfect, but it follows all the best practices for regulated exchanges.

Is Bitget’s UEX the same as UEX Crypto Exchange?

No. They’re completely different. UEX Crypto Exchange is a U.S.-only, compliance-focused platform for trading crypto. Bitget’s Universal Exchange (UEX) is a global feature set within Bitget that lets you trade tokenized stocks and crypto futures. The shared name is confusing, but they have no connection.

Can I trade Apple stock on UEX Crypto Exchange?

No. UEX Crypto Exchange only supports cryptocurrencies like Bitcoin, Ethereum, and other major altcoins. You cannot trade stocks, ETFs, or any traditional assets on this platform. That feature is exclusive to Bitget’s Universal Exchange.

Does UEX Crypto Exchange have a mobile app?

Yes, UEX Crypto Exchange offers official mobile apps for iOS and Android. The interface is clean and focused on trading crypto with simple buy/sell functions. It’s not designed for advanced charting or derivatives - just straightforward, secure trading.

What’s the minimum deposit on UEX Crypto Exchange?

The minimum deposit is $10 or its equivalent in cryptocurrency. That’s standard for most regulated exchanges. You can deposit via bank transfer, wire, or crypto. Withdrawals require full KYC verification and take 1-3 business days.

Are there any hidden fees on Bitget’s UEX?

Bitget discloses all fees clearly on their website. Trading fees are tiered based on volume. There are no hidden charges, but funding rates for futures contracts can vary. Always check the fee schedule before placing leveraged trades. The $700M protection fund covers losses from hacks - not poor trading decisions.

Can I use UEX if I’m not in the U.S.?

The standalone UEX Crypto Exchange is only available to U.S. residents due to its regulatory licensing. If you’re outside the U.S., you can’t sign up. However, you can use Bitget’s Universal Exchange (UEX), which is available globally, except in restricted jurisdictions like the U.S., Canada, and a few others.

Final Thoughts

UEX isn’t one thing. It’s two paths - one rooted in regulation, the other in innovation. Pick the one that matches your goals, not your curiosity. If you want clean, legal crypto trading in the U.S., UEX Crypto Exchange is a solid choice. If you want to trade Apple stock with Bitcoin and don’t mind complexity, Bitget’s UEX is groundbreaking.

Don’t let the name fool you. Read the fine print. Know what you’re signing up for. And never trade more than you can afford to lose - no matter how fancy the platform looks.

Gary Gately

February 3, 2026 AT 12:35man i just clicked on this thinking it was one platform and now i’m confused af. uex? which uex? why do they both have the same name?? someone please tell me i’m not the only one who just lost 20 minutes of my life to this.