NFT Ownership Verification Tool

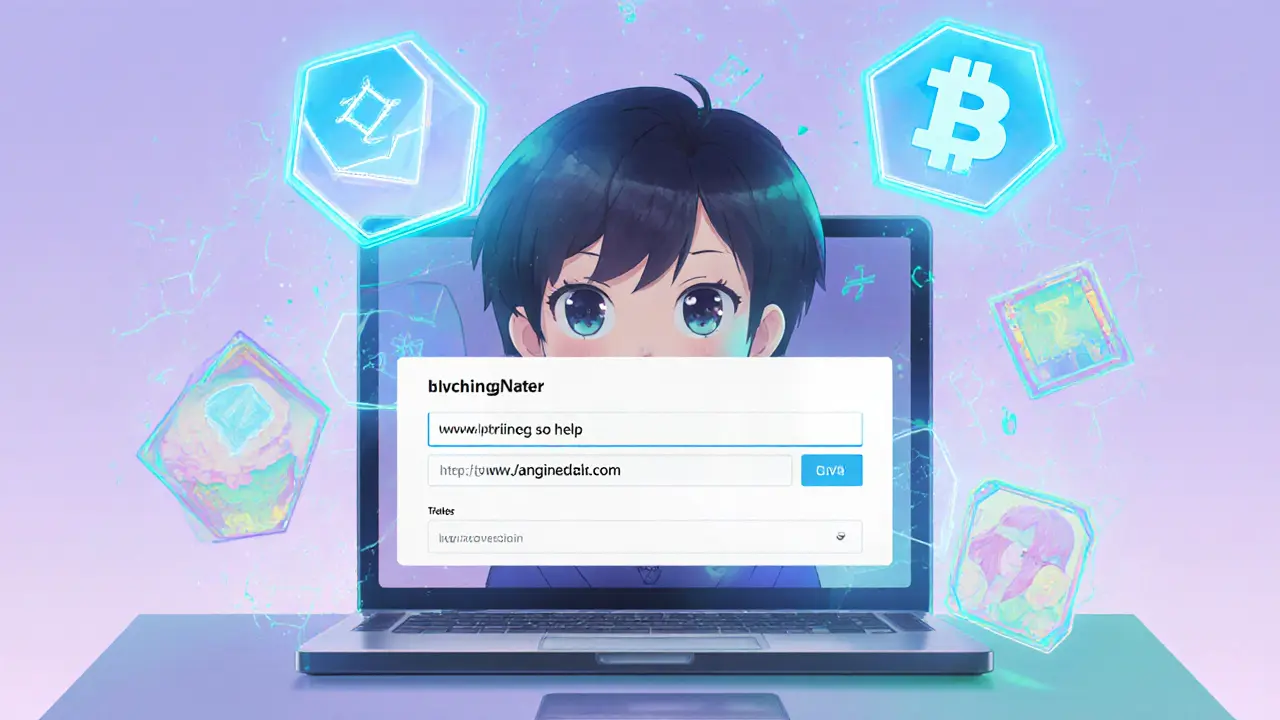

Verify NFT Ownership

Enter the contract address and token ID to check current ownership on the blockchain.

How It Works

This tool simulates the verification process by checking the blockchain for the specified NFT. In a real-world scenario, this would connect to a blockchain explorer API like Etherscan.

- Enter the contract address of the NFT collection

- Enter the token ID of the specific NFT

- Click "Verify Ownership" to check the current holder

- The result will show if the ownership is confirmed or if there are issues

Note: This is a simulation for demonstration purposes only. Actual verification requires connecting to blockchain explorers or APIs.

When you buy a digital artwork, a virtual land plot, or a tokenized sneaker, the biggest question is: *do I really own it?* NFT ownership verification gives you a transparent, tamper‑proof way to answer that, using the same public ledger that created the token. This guide walks you through the why, what, and how of confirming who holds an NFT, from simple explorer checks to programmatic APIs.

What “ownership” Means in the NFT World

NFT is a non‑fungible token that represents a unique digital or physical asset on a blockchain. Each NFT has a token ID and lives under a specific contract address, forming a permanent digital fingerprint.

Unlike a bank account, an NFT doesn’t rely on a central authority. Ownership is recorded directly on the distributed ledger by the smart contract that enforces transfer rules, royalty splits, and any custom logic.

Crucially, owning the token does not automatically grant copyright or commercial rights - it simply gives you control over the token itself. That distinction becomes a frequent source of confusion, so the verification process must confirm both the token’s custody and any associated usage terms stated in the contract.

Why Verify? Real‑World Risks and Benefits

Verification protects against three common pitfalls:

- Fake listings - Scammers copy images and claim ownership without a matching on‑chain record.

- Escrow traps - Marketplaces may hold an NFT in escrow; the listed owner appears as the buyer, but the token remains in a smart‑contract pool.

- Cross‑chain confusion - Wrapped NFTs on another chain can show a different holder than the original source chain.

By checking the blockchain, you cement confidence that the address you see truly controls the token at the moment of purchase.

Step‑by‑Step Manual Verification Using Etherscan

Etherscan is a free blockchain explorer for Ethereum and compatible networks. It provides the most granular view of token movements.

- Locate the wallet, transaction hash, block number, or token contract you want to investigate. Paste it into the search bar.

- On the token page, click the “Token Tracker” link to open the contract’s overview.

- Select the “Transfers” tab. Use the filter box to enter the specific token ID (e.g.,

#12345). - Find the latest transfer entry. The “To” address shown is the current holder. Click the address to see its full transaction history.

- Confirm the token’s status: look for a green “Success” label and verify that the gas fee was paid by the same address you expect to own it.

For deeper insight, expand the transaction details to view the input data field - it often includes the contract’s method call, confirming whether the transfer was a sale, gift, or marketplace escrow.

Tools for Power Users and Developers

Manual checks are fine for occasional purchases, but large portfolios or automated workflows need specialized tools.

- Nansen offers advanced analytics, tagging wallets as collectors, whales, or wash‑traders. It’s subscription‑based but invaluable for high‑value due diligence.

- DappRadar aggregates multi‑chain activity, letting you track NFTs on Ethereum, Polygon, Solana, and others from a single dashboard.

- OpenSea provides a marketplace‑centric view. Its “View on Explorer” button jumps directly to Etherscan, but remember it only shows NFTs listed on OpenSea.

- Tatum SDK delivers programmatic access to token ownership data. With a few lines of code you can pull the current holder, provenance chain, and metadata JSON for any ERC‑721 or ERC‑1155 token.

Below is a quick comparison of these tools against key criteria.

| Tool | Free Access | Multi‑Chain Support | Analytics Depth | API Availability |

|---|---|---|---|---|

| Etherscan | Yes | Ethereum only (Layer‑2 via separate explorers) | Basic transaction view | Yes (rate‑limited) |

| OpenSea | Yes | Ethereum, Polygon, Klaytn | Marketplace‑centric stats | No (only JSON feeds) |

| Nansen | No (paid plans) | Ethereum, BSC, Polygon | Advanced wallet labeling, profit tracking | Yes (REST) |

| DappRadar | Limited free tier | 15+ chains | Portfolio aggregation | Yes (API) |

| Tatum SDK | Free tier (250 calls/day) | Ethereum, Polygon, Binance Smart Chain, others | Programmatic ownership + metadata | Yes (SDK & REST) |

Understanding NFT Metadata - The Hidden Proof Layer

The on‑chain token only points to off‑chain data through a URI (often IPFS). Verifying ownership also means confirming that the metadata truly belongs to the token you hold.

- Token URI - Stored in the smart contract; points to a JSON file.

- Image hash - A SHA‑256 or IPFS CID that proves the image hasn’t been swapped.

- Creator verification - Some contracts include a

verifiedCreatorfield that matches the creator’s wallet address.

When you open the token’s JSON (via Etherscan or a tool like IPFS gateway), check that the name, description, and image fields match the asset you purchased. Any discrepancy is a red flag.

Cross‑Chain and Wrapped NFTs - Extra Verification Steps

Wrapped NFTs are copies of an original token that live on a different blockchain (e.g., an Ethereum NFT bridged to Polygon). The wrapper contract holds the original token, while the wrapped token represents it on the new chain.

To verify true ownership:

- Identify the original contract address on the source chain.

- Check the wrapper contract’s

ownerOfmethod for the wrapped token ID. - Confirm that the wrapper contract’s

bridgeOwnerfield points back to the original holder.

If the two addresses differ, the holder on the target chain may only have a usage right, not the ultimate ownership.

Common Pitfalls and How to Avoid Them

- Escrow confusion - Some marketplaces lock NFTs in a smart‑contract escrow. Look for the contract address in the “To” field; if it’s a known marketplace escrow, the actual owner is still the buyer after the sale finalizes.

- Metadata hijacking - A malicious actor can replace the image URL if the token points to a mutable HTTP endpoint. Prefer IPFS or other immutable storage.

- Phishing explorers - Fake “Etherscan clones” may show altered data. Always double‑check the URL and SSL certificate.

- Multi‑signature wallets - Ownership may be shared among several signers. Examine the wallet’s transaction history to see who approved the latest transfer.

Quick Checklist Before You Finalize Any NFT Purchase

- Copy the exact contract address and token ID from the listing.

- Open the token on Etherscan (or the native explorer for the chain).

- Verify the latest

ownerOfentry matches the seller’s address. - Inspect the token metadata URI; confirm image hash and creator fields.

- If the NFT is wrapped, repeat the steps on the source chain.

- Cross‑reference with at least one analytics tool (Nansen, DappRadar) to spot wash‑trading or blacklisted wallets.

Future of NFT Ownership Verification

Emerging AI‑driven services promise to auto‑scan metadata, flag mismatches, and even generate a confidence score for each token. Cross‑chain standards like EIP‑7212 aim to embed provenance checkpoints directly into contracts, making verification a single‑click operation on any wallet.

Legal frameworks are also catching up. Some jurisdictions are drafting legislation that treats a verified NFT token as a legally enforceable title for physical assets, provided the on‑chain record is backed by a notarized off‑chain registry. When that happens, the verification process will double as a legal due‑diligence step.

Next Steps & Troubleshooting

If you hit a dead end-like a missing token ID or an unresponsive explorer-try these remedies:

- Switch to a blockchain‑specific explorer (e.g., Polygonscan for Polygon).

- Use the Tatum SDK to fetch ownership via API; it often bypasses UI rate limits.

- Contact the seller for the original contract address and a transaction receipt.

- Check community forums (r/NFT, Discord channels) for known scams involving that contract.

Remember, the blockchain itself never lies-issues usually stem from user error or outdated tooling.

Frequently Asked Questions

How can I tell if an NFT listed on a marketplace is actually owned by the seller?

Copy the contract address and token ID, paste them into the chain’s explorer (Etherscan for Ethereum, Polygonscan for Polygon). Look for the most recent Transfer event; the “To” address should match the seller’s wallet. If the token sits in a known escrow contract, confirm that the escrow will release it to the buyer after payment.

Does owning an NFT give me the copyright to the underlying artwork?

Usually not. The token proves you control the digital certificate, but copyright stays with the creator unless the smart contract explicitly transfers those rights. Always read the creator’s licensing terms before assuming you can reproduce or sell the artwork.

What’s the difference between a wrapped NFT and the original?

A wrapped NFT is a token minted on a secondary chain that represents the original token locked in a bridge contract. The wrapper grants usage on the new chain, but the real ownership is still recorded on the source chain. Verify both contracts to be certain of true ownership.

Can I automate ownership checks for an entire portfolio?

Yes. Services like the Tatum SDK or Alchemy’s NFT API let you pull the ownerOf field for any list of token IDs. Combine that with a periodic script to flag any address changes, and you have a live verification dashboard.

What should I do if the metadata URL points to a dead link?

A dead link often means the asset was stored on a centralized server that went offline. That’s a red flag-reach out to the seller for a new, preferably IPFS‑based, URI. If they can’t provide one, consider the token unreliable.

Holly Harrar

September 12, 2025 AT 06:25Just plug the contract address and token ID, hit verify, and you’ll see the owner instntly.

Vijay Kumar

September 18, 2025 AT 05:00Nice guide! I love how you break down the manual steps on Etherscan, then seamlessly transition to API options. The energy in the “why verify” section really drives home the stakes, especially with those escrow traps. If you're hustling a big portfolio, the Tatum SDK tip is pure gold – just swap the demo calls for real endpoints. Overall, this post makes the tech feel approachable without sacrificing depth.

Edgardo Rodriguez

September 24, 2025 AT 03:35When we contemplate the notion of ownership on a decentralized ledger, we are forced to confront a cascade of epistemological layers, each one interwoven with technical nuance, legal ambiguity, and cultural narrative; the guide, therefore, serves not merely as a procedural manual but as a philosophical roadmap. First, the act of querying a contract address summons the immutable record of all past transfers, a chorus of digital signatures that echo through the blockchain’s immutable history. Second, the tokenID functions as a unique fingerprint, a singular beacon that distinguishes one artifact from another, much like a DNA strand in a biological organism; this parallel underscores the sanctity of each NFT’s provenance. Third, the dichotomy between on‑chain custody and off‑chain metadata beckons the observer to ask whether true ownership resides in the address or in the content it points to; the answer, inevitably, is a symbiosis of both, contingent upon the immutable hash that anchors the asset. Fourth, the guide’s emphasis on cross‑chain wrapped tokens illustrates the fluidity of digital assets, reminding us that an NFT can be both rooted and migratory, a traveler navigating bridges between ecosystems, each bridge governed by its own smart contract logic. Fifth, the discussion of royalty enforcement reveals a subtle economic governance model, where creators embed perpetual income streams within the token’s code, a practice that challenges conventional notions of intellectual property. Sixth, the cautionary notes on phishing explorers and mutable HTTP endpoints highlight the ever‑present human factor, the vulnerability that no amount of code can fully eradicate. Seventh, the integration of analytic platforms such as Nansen and DappRadar adds a sociological layer, enabling us to map the behavior of collectors, whales, and wash‑traders across the market’s tapestry. Eighth, the mention of legal frameworks in emerging jurisdictions invites a speculative glimpse into a future where blockchain records might be recognized as de jure titles, cementing the legal weight of what is today a purely technical assertion. Ninth, the recurring theme of metadata verification – checking IPFS CIDs, confirming creator fields, and validating image hashes – serves as a reminder that trust is built not only on code but on reproducible content. Tenth, the practical troubleshooting steps, from switching explorers to leveraging SDK calls, provide a pragmatic toolbox that empowers users to overcome obstacles rather than be deterred by them. Eleventh, the guide’s structure, moving from “why” to “how” to “what next,” mirrors the cognitive journey of a newcomer to an expert, a pedagogical design that respects the learner’s evolution. Twelfth, the inclusion of a simulated verification tool, though simple, offers an interactive glimpse into the user experience, a valuable bridge between theory and practice. Thirteenth, the clear delineation of escrow mechanisms versus true ownership demystifies marketplace dynamics, allowing buyers to navigate transactions with confidence. Fourteenth, the emphasis on immutable storage solutions, such as IPFS, confronts the risk of centralized server failures, a critical consideration for long‑term asset preservation. Fifteenth, the guide’s call to cross‑reference multiple sources before finalizing a purchase instills a habit of due diligence that is essential in a space rife with scams. Finally, by weaving together technical instructions, strategic insights, and forward‑looking speculation, the article not only equips readers with immediate tools but also invites them to partake in the ongoing discourse that shapes the future of digital ownership.

mudassir khan

September 30, 2025 AT 02:10The article, while exhaustive, suffers from an overreliance on generic tool listings and fails to interrogate the underlying security assumptions of each platform; consequently, readers are left with a superficial checklist rather than a rigorous threat model. Moreover, the absence of quantitative risk metrics-such as false‑positive rates for metadata validation-undermines the practical utility of the recommendations. In short, the guide is a collection of buzzwords without substantive analysis.

Bianca Giagante

October 6, 2025 AT 00:45I appreciate the thoroughness of the checklist; it captures the essential steps without overwhelming newcomers. The emphasis on verifying both on‑chain ownership and off‑chain metadata is a prudent reminder that authenticity extends beyond a simple wallet address. Thank you for the clear layout.

Andrew Else

October 11, 2025 AT 23:21Great, another tutorial that tells us to “just check Etherscan.” Because no one ever forgets to open a block explorer.

Susan Brindle Kerr

October 17, 2025 AT 21:56One must recognize that the very act of verification transcends mere technicality; it is an existential affirmation of digital sovereignty.

Jared Carline

October 23, 2025 AT 20:31While the philosophical framing is noted, the pragmatic focus on actionable steps remains paramount; lofty rhetoric, however elegant, must ultimately serve the investor’s need for verifiable assurance.

raghavan veera

October 29, 2025 AT 18:06Thinking about wrapped NFTs, it’s like owning a passport that works in another country-you still need to check the original visa stamp to be sure it’s legit.

Danielle Thompson

November 4, 2025 AT 16:41Spot on! Verify the token ID and double‑check the metadata ✅🚀

Eric Levesque

November 10, 2025 AT 15:17Actually, most people just copy‑paste the address into Etherscan; if you can’t do that, you’re missing the basics.

alex demaisip

November 16, 2025 AT 13:52The integration of SDK endpoints, rate‑limit considerations, and provenance hash verification constitutes a multi‑layered validation architecture that aligns with industry‑standard best practices, thereby mitigating exposure to oracle manipulation and metadata tampering vectors.

Elmer Detres

November 22, 2025 AT 12:27Exactly-combining on‑chain checks with IPFS hash verification creates a robust defense against spoofed assets. Keep the tools handy! 👍🔧

Tony Young

November 28, 2025 AT 11:02The battle for authenticity is a saga of code versus deception; every successful verification is a triumph worthy of celebration! 🎉💎

Fiona Padrutt

December 4, 2025 AT 09:37Our community must demand transparent ownership tools; we can’t let foreign gatekeepers dictate the standards of NFT verification.

Briana Holtsnider

December 10, 2025 AT 08:13Such hyper‑nationalist rhetoric distracts from the genuine technical issues and adds an unwelcome layer of bias to an otherwise objective discussion.

Corrie Moxon

December 16, 2025 AT 06:48Let’s keep sharing these practical guides so everyone can navigate the NFT space with confidence and clarity.

Jeff Carson

December 22, 2025 AT 05:23Has anyone experimented with real‑time webhook alerts for ownership changes? It would be fascinating to see how those integrations perform across different chains.