Oasis Network is a Layer 1 blockchain built for privacy and scalability. Launched in 2018 by UC Berkeley professor Dawn Song, it raised $45 million from investors like a16z crypto and Polychain Capital. Unlike most blockchains that trade off privacy for speed, Oasis handles both using its unique two-layer design. Today, it powers real-world applications like confidential DeFi and AI tools while staying fully decentralized.

How Oasis Network Works

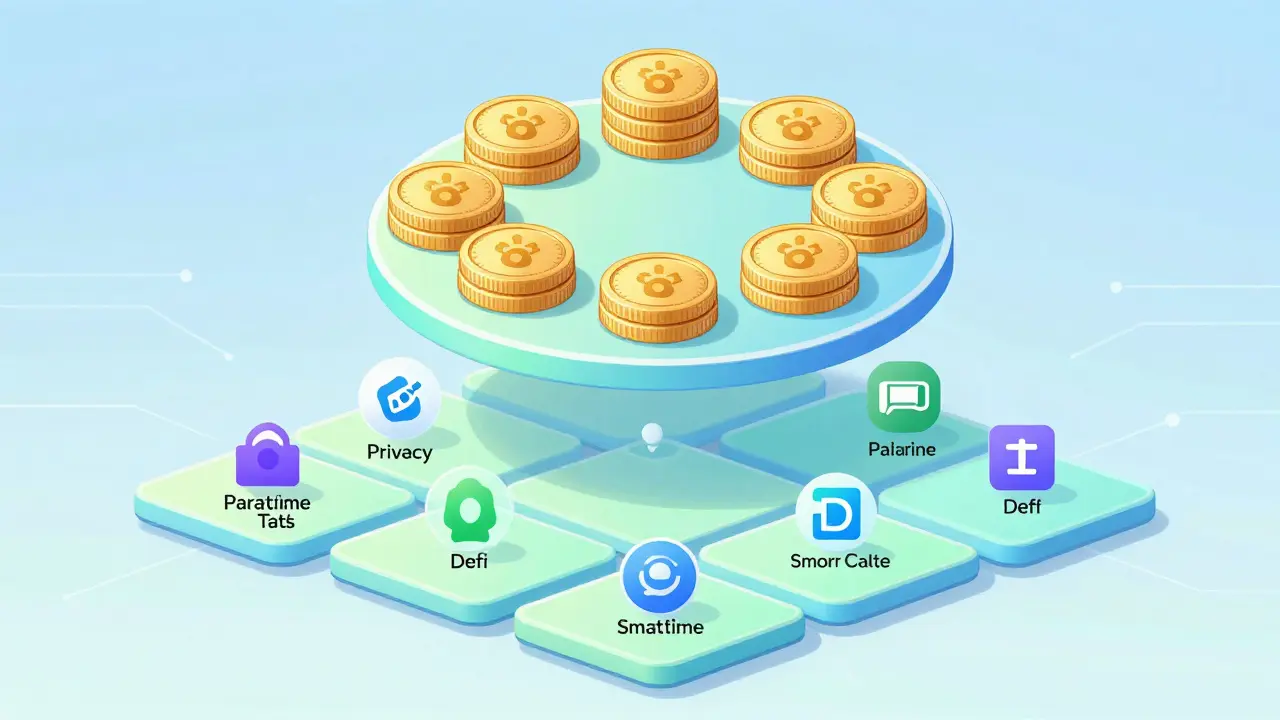

Oasis splits its operations into two layers. The consensus layer handles security and transaction ordering using proof-of-stake. Validators stake ROSE tokens to secure the network and earn rewards. Meanwhile, the ParaTime layer runs multiple parallel compute environments. Each ParaTime can have different rules-some for confidential transactions, others for standard smart contracts. This separation means heavy workloads on one ParaTime won’t slow down others. For example, a DeFi app using encrypted transactions won’t interfere with a simple token transfer on another ParaTime.

Oasis uses confidential computing through secure enclaves. Data stays encrypted while being processed, unlike traditional blockchains where all data is visible. This isn’t an add-on feature-it’s built into the core architecture. The network’s discrepancy detection system also makes it more efficient than sharding or parachains, requiring fewer nodes for the same security level.

What Is the ROSE Token?

ROSE is Oasis Network’s native cryptocurrency. It has a maximum supply of 10 billion tokens. As of late 2025, ROSE trades at $0.01758 with a 24-hour trading volume of $30 million. ROSE does four key jobs: paying gas fees for transactions, staking to secure the network, delegating to validators, and voting in governance proposals. Staking yields typically range between 5% and 10% annually, depending on network participation.

ROSE holders control the network’s future. Major upgrades like new ParaTimes or protocol changes require community approval through token-based voting. This makes ROSE more than just a currency-it’s the backbone of Oasis’ decentralized governance.

Key Products: Privacy for Real-World Use

Oasis offers three main products that solve real problems:

- Oasis Sapphire-the world’s only confidential EVM in production. It lets developers deploy encrypted smart contracts that keep data private while using familiar Ethereum tools. For example, a healthcare app could store patient records on-chain without exposing sensitive details.

- Oasis Privacy Layer-a plug-and-play privacy solution for existing dApps. Developers can add encryption to any EVM-based app without rebuilding it. A DeFi protocol could use this to hide trade details while keeping transactions verifiable.

- ROFL (Rollup Offchain Function Layer)-a framework for verifiable off-chain compute. It uses Intel TDX Trusted Execution Environments to run AI models or data processing securely. This lets companies build AI tools that don’t expose user data to third parties.

Together, these create "Smart Privacy"-customizable privacy that can be fully private, fully public, or anything in between. This flexibility is why companies like Chainlink and Fetch.ai are building on Oasis for confidential AI applications.

Oasis vs. Ethereum: Why It Matters

| Feature | Oasis Network | Ethereum |

|---|---|---|

| Transaction fees | Consistently under $0.01 per transaction | Can exceed $50 during peak usage |

| Scalability | Increases with more nodes (parallel processing) | Requires sharding (not fully implemented) |

| Privacy features | Core to architecture (confidential computing) | Added as optional layers |

| Development environment | EVM-compatible via Oasis Sapphire | Native EVM |

Oasis solves Ethereum’s pain points. While Ethereum struggles with high fees and slow speeds during congestion, Oasis maintains low costs and fast processing regardless of network load. Privacy is another big difference-Ethereum’s privacy features are bolted on as separate tools, but Oasis builds privacy into every layer from the start. This makes Oasis ideal for applications handling sensitive data like healthcare records or financial transactions.

Current Market Status and Adoption

As of late 2025, ROSE trades on major exchanges like Binance, Coinbase, and Kraken. Its market cap sits around $175 million, placing it in the mid-tier cryptocurrency space. Adoption is growing steadily, with over 100 dApps live on the network. Notable projects include:

- Privacy-focused DeFi protocols that hide trade details while offering high yields

- AI data marketplaces that let users sell data without revealing personal information

- Healthcare platforms storing medical records on-chain with patient-controlled access

Despite these gains, Oasis still faces challenges. It has fewer developers than Ethereum or Solana, and mainstream users often don’t understand privacy blockchains. However, as regulations tighten around data privacy globally, Oasis’ core technology could become essential for compliant Web3 applications.

What’s Next for Oasis Network

Oasis is focused on three areas for 2026:

- Expanding cross-chain interoperability with other Cosmos networks like Terra and Cosmos Hub

- Adding enterprise-grade tools for confidential AI compute through ROFL

- Onboarding more developers via hackathons and grants for privacy-focused dApps

Industry analysts believe Oasis is uniquely positioned as data privacy becomes a global priority. With regulations like GDPR and CCPA forcing companies to rethink data handling, blockchains that offer built-in confidentiality could see explosive growth. Oasis’ team has already secured partnerships with major tech firms like Intel and Microsoft to integrate their confidential computing tech.

What is the ROSE token used for?

ROSE serves four critical roles in Oasis Network. First, it pays gas fees for transactions and smart contracts. Second, it enables staking-holders can lock ROSE to validate transactions and earn rewards. Third, it allows delegation to validator nodes for those who don’t run nodes themselves. Finally, ROSE holders vote on network upgrades and governance proposals. With a maximum supply of 10 billion tokens, ROSE’s value is tied directly to network usage and adoption.

How does Oasis Network ensure privacy?

Oasis uses confidential computing through secure enclaves. Data stays encrypted during processing, unlike traditional blockchains where all data is visible. For example, Oasis Sapphire allows developers to deploy encrypted smart contracts that keep transaction details private while still being verifiable on-chain. This isn’t an add-on-it’s built into the network’s core architecture. The ParaTime layer processes data in isolated environments, ensuring no third party can access raw information.

Can I stake ROSE tokens?

Yes. Staking ROSE helps secure the network. Validators need to stake ROSE to participate in consensus. Regular users can delegate their tokens to validators and earn rewards. Current staking yields range between 5% and 10% annually, depending on network participation rates. Staking is done through the Oasis Wallet or compatible platforms like Keplr. Rewards are distributed daily and paid in ROSE tokens.

How is Oasis different from other privacy blockchains?

Most privacy blockchains focus solely on confidentiality but sacrifice scalability. Oasis combines privacy with high throughput through its two-layer design. For example, Monero and Zcash prioritize privacy but have slower transaction speeds. Oasis processes transactions in parallel via ParaTimes, allowing it to scale without compromising security. It also offers more flexibility-developers can choose between fully private or public ParaTimes based on their needs, which isn’t possible on single-purpose privacy chains.

Is Oasis Network part of the Cosmos ecosystem?

Yes. Oasis is built on the Cosmos SDK and uses the Inter-Blockchain Communication (IBC) protocol. This allows it to connect seamlessly with other Cosmos-based blockchains like Terra and Cosmos Hub. Developers can easily build cross-chain applications that move assets between Oasis and other Cosmos chains. This interoperability is a key advantage over standalone privacy blockchains that operate in isolation.